In the dynamic landscape of the construction and renovation industry, financial strategies often dictate the trajectory of a company’s growth and sustainability. Among the players in this sector,Roof Renovation (WSE:RRH) has been stirring interest as analysts scrutinize its financial habits. Debt, while a vital tool for expansion, can also pose meaningful risks if not managed judiciously. In this article, we delve into four key measures that illuminate the extent to which Roof Renovation is leveraging debt in its operations. By examining these indicators, we aim to provide a clearer picture of the company’s financial standing and future prospects, offering investors and stakeholders critical insights into its strategic choices. Join us as we explore the intricate relationship between Roof Renovation’s growth ambitions and its reliance on borrowed capital.

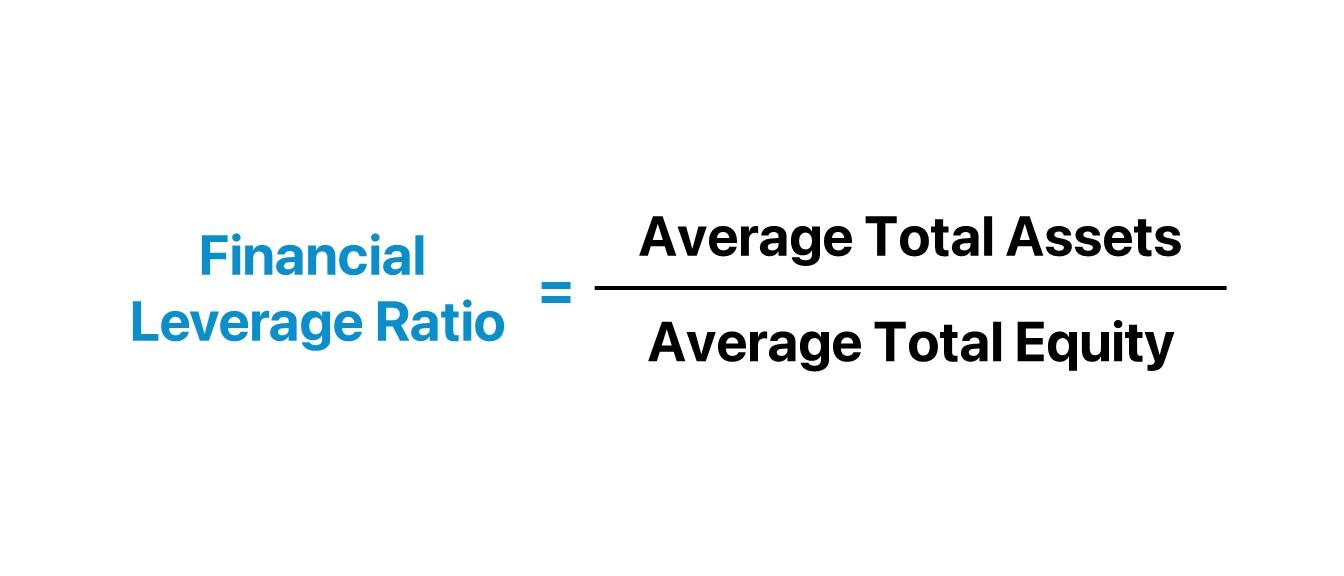

When evaluating the financial health of a company like Roof renovation, several key indicators reveal the extent of its reliance on debt. First, a significant debt-to-equity ratio can suggest that the company is financing a considerable portion of its operations through loans rather than through owner equity. This ratio not only reflects the balance between total liabilities and shareholders’ equity but also highlights the risk associated wiht leveraging.Another crucial metric is the interest coverage ratio, which assesses the firm’s ability to pay interest on its outstanding debt. A lower ratio may signify that Roof Renovation is facing difficulties in meeting its debt obligations, indicating potential over-leverage.

Moreover, scrutinizing the cash flow-to-debt ratio presents further insights into the company’s financial sustainability. A declining trend in this ratio could indicate that Roof Renovation is increasingly dependent on external financing to support its operations rather than generating sufficient cash flow from its activities. Additionally, the total liabilities-to-assets ratio offers a snapshot of how much of the company’s assets are financed through debt. A high percentage here may suggest that the company is heavily leveraged,creating an increased risk profile that could affect its long-term growth and stability. Understanding these financial indicators is crucial for investors looking to assess the risk associated with their investment in Roof Renovation.

Debt can be a double-edged sword for companies like Roof Renovation. While it can provide a crucial lifeline for funding essential projects and innovations, excessive reliance on it poses significant risks to long-term viability. evaluating key financial metrics can shed light on whether a company’s debt levels are enduring. For instance, analyzing the debt-to-equity ratio reveals how much leverage is being used in relation to shareholder equity. If this ratio is high, it can indicate a potential vulnerability should market conditions shift unfavorably.

Additionally, examining interest coverage ratios provides further insights into the company’s ability to meet its debt obligations. A low coverage ratio could suggest that the firm’s earnings are insufficient to cover interest expenses, putting it at risk during downturns. Other important indicators include debt-to-assets ratios, which offer a glimpse into the financial structure of the company, and cash flow analysis, highlighting whether operational cash flow is adequate to manage debt repayments. When monitoring these factors, investors should remain vigilant to ensure that the company is not only surviving but thriving as it navigates the waters of borrowed capital.

Borrowing extensively can provide companies like Roof renovation (WSE:RRH) with the capital needed to expand and enhance their operations, but it also introduces a set of risks that stakeholders must carefully consider.While leveraging debt can amplify growth potential, it can equally amplify vulnerability during economic downturns. Key risks include interest rate fluctuations, which can lead to higher repayment costs, and debt covenants, which may restrict company operations or require compliance to certain financial metrics that could hinder flexibility.

Moreover, companies heavily reliant on debt may face cash flow problems if revenue projections fall short, leading to difficulties in meeting repayment obligations. A high debt-to-equity ratio can signal that a company is over-leveraged, increasing the risk of bankruptcy in severe market conditions. Investors should evaluate the debt ratios and assess the sustainability of the company’s financial practices. The following table highlights critical indicators to monitor the implications of extensive borrowing:

| Indicator | Implication |

|---|---|

| Debt-to-Equity Ratio | Higher ratios suggest increased financial risk. |

| Interest Coverage Ratio | Low ratios indicate potential trouble in meeting interest payments. |

| Cash Flow Margin | Declining margins may challenge debt servicing capabilities. |

| Current Ratio | Indicates liquidity; low values point to potential short-term financial strain. |

To navigate the complexities of their financial commitments, Roof Renovation (WSE:RRH) should adopt a multifaceted approach to ensure long-term sustainability and mitigate potential risks associated with extensive debt. An effective strategy may include:

Moreover, Roof Renovation should maintain transparent communication with stakeholders regarding their debt strategy and financial health. This proactive approach could encompass:

| Measure | Current Status | Strategic Goal |

|---|---|---|

| Debt-to-Equity Ratio | High | Reduce by 20% over 2 years |

| Interest Coverage Ratio | Low | Maintain a minimum of 2.5 |

| Cash Reserves | Insufficient | Increase by 30% within 1 year |

In the intricate dance of corporate finance, the measures we’ve explored reveal a compelling narrative surrounding Roof Renovation (WSE:RRH) and its strategic approach to debt. As we unravel the layers of its financial structure, it becomes evident that while leveraging debt can signal ambition and growth, it also comes with inherent risks that warrant careful consideration. Investors and stakeholders alike must weigh these factors in the context of their broader investment strategies.

Ultimately, understanding the nuances of Roof Renovation’s debt usage is key to making informed decisions. As the company continues to navigate its financial landscape, keeping a watchful eye on these indicators will be essential. Whether you view their approach as a bold move toward expansion or a precarious balancing act, one thing is clear: the road to renovation is rarely paved with certainty, and Roof Renovation’s journey is just beginning.