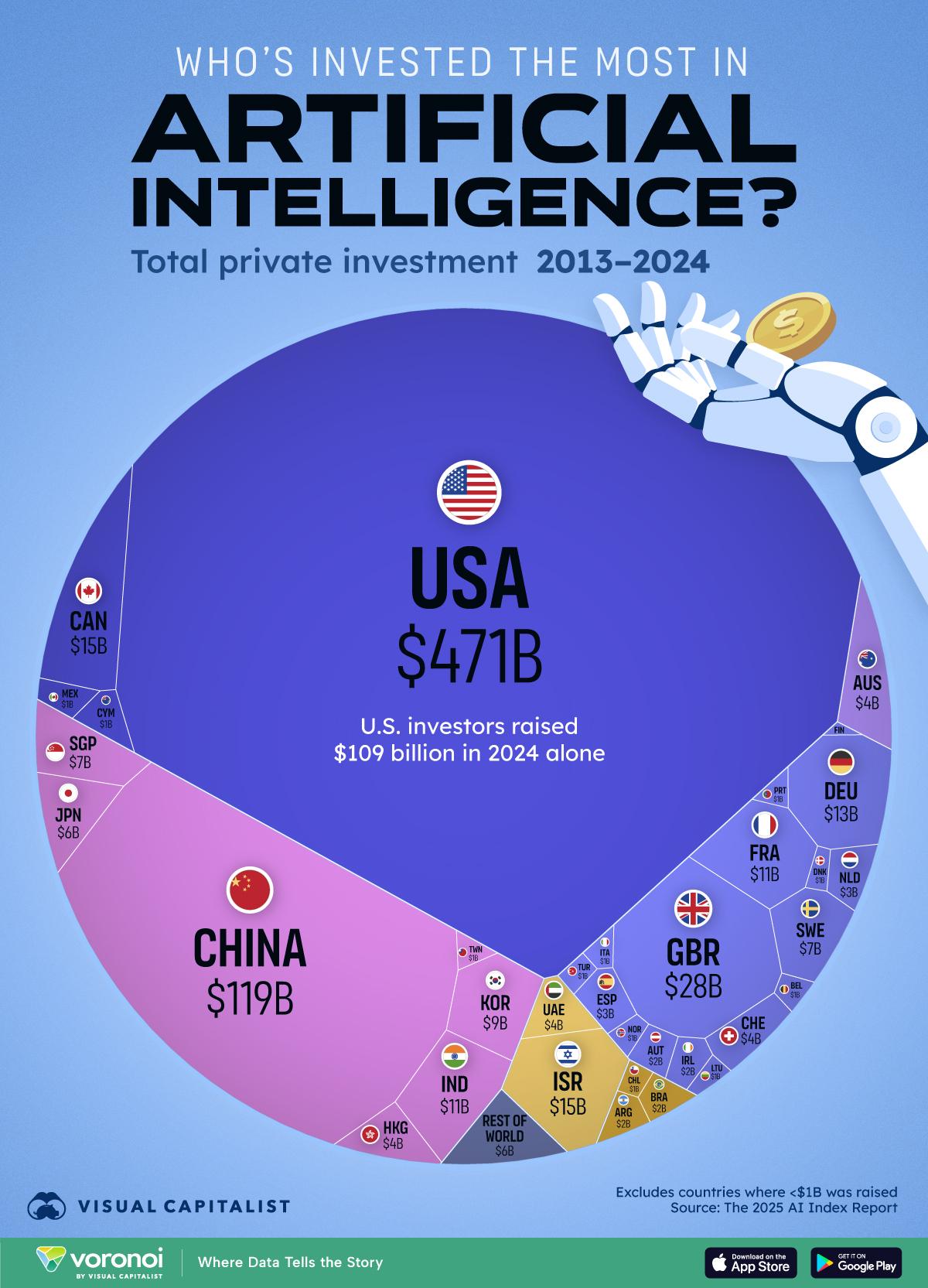

As the tech landscape continues to evolve at an unprecedented pace, the spotlight is increasingly shining on artificial intelligence and its transformative potential. With giants like Meta and Microsoft ramping up their investments and innovations in this cutting-edge arena, the question arises: where dose that leave NVIDIA, a key player in AI hardware and software? As these two companies forge ahead in their AI endeavors, propelled by aspirations to redefine user experiences and expand their digital ecosystems, investors are left contemplating a strategic dilemma. Should you hold on to your NVIDIA stock, or is it time to reassess your portfolio? In this article, we delve into the intersection of AI advancements, market dynamics, and NVIDIAS pivotal role amidst the growing competition from Meta and Microsoft. Join us as we explore the intricacies of this tech showdown and its implications for your investment decisions.

As tech giants like Meta and Microsoft aggressively ramp up their investments in artificial intelligence, the pressure on NVIDIA to maintain its competitive edge becomes increasingly intense. While NVIDIA has long been a leader in AI hardware, the shifting competitive landscape demands a strategic evaluation of its market position. Potential investors should consider the recent developments from these companies,particularly their initiatives in AI innovation and product offerings,which could redefine the industry standards. The investments made by these competitors enhance their capabilities in data processing and machine learning, further challenging NVIDIA’s dominance in the semiconductor market.

To better grasp the implications of these investments, it’s essential to look at the following factors:

| Company | AI Investment (2023) | Projected Growth Rate |

|---|---|---|

| NVIDIA | $10 billion | 15% |

| Meta | $8 billion | 20% |

| Microsoft | $9 billion | 25% |

NVIDIA has long been recognized as a leader in the graphics processing unit (GPU) market, primarily due to its cutting-edge innovations that have significantly advanced AI capabilities. With the rapid evolution of deep learning and machine learning technologies, its dominance has placed it at the forefront of industries ranging from gaming to autonomous vehicles. This technological advantage is characterized by:

However, amidst increasing competition from major players like Meta and Microsoft, the sustainability of this edge comes into question. As these tech giants ramp up their investments in AI infrastructure and begin to unveil proprietary technologies, NVIDIA must continuously innovate to stay ahead. Factors that could influence its competitiveness include:

In recent months, NVIDIA has positioned itself as a key player in the rapidly evolving AI landscape, particularly as Meta and Microsoft significantly increase their investments. The demand for GPUs, which are essential for AI and machine learning tasks, continues to surge, placing NVIDIA at the forefront of this technological revolution. As the market shifts to incorporate more advanced AI capabilities, NVIDIA’s revenue streams have diversified and strengthened. Key factors contributing to their robust position include:

Though, the competitive landscape is intensifying. Both Meta and Microsoft are not just content with their existing capabilities; they are actively seeking to innovate and capture a larger share of the AI market. This competition is affecting stock market perceptions and may influence investor sentiment toward NVIDIA. assessing their performance involves looking closely at:

| Metric | NVIDIA | Meta | Microsoft |

|---|---|---|---|

| Recent Stock Price | $XX.XX | $XX.XX | $XX.XX |

| Market Cap | $XX Billion | $XX Billion | $XX Billion |

| AI Investment | $X Billion | $X Billion | $X Billion |

Ultimately, navigating this competitive terrain requires an analysis not just of NVIDIA’s strengths but also of how well it can maintain its edge against formidable rivals who are scaling their own AI ambitions. Investors will need to weigh these dynamics carefully to ascertain whether holding NVIDIA stock aligns with their financial goals.

As the AI landscape evolves,the timing of a reevaluation of your NVIDIA holdings becomes paramount. The surge in AI investment from giants like Meta and Microsoft underscores the competitive nature of the sector. Strategic investors should consider several factors to determine whether NVIDIA remains a cornerstone of their portfolio:

Additionally, a careful examination of how external factors influence NVIDIA’s stock is vital. Consider keeping track of the following:

| Factor | Possible Impact |

|---|---|

| Emerging Competitors | Potential margin compression if new entrants provide innovative solutions. |

| Regulatory Changes | Shifts in government policies could affect operational flexibility. |

| Technological Advancements | Innovation may alter the demand for GPU products. |

As we navigate the dynamic landscape of technology and investment,the decision to hold NVIDIA stock amidst the intensifying AI arms race led by Meta and Microsoft is not just a question of financial strategy,but a reflection of the broader shifts in innovation and market potential. NVIDIA’s pivotal role in AI infrastructure positions it uniquely within this rapidly evolving field, offering both opportunities and risks for forward-thinking investors.While the allure of ample AI advancements propels tech giants towards unprecedented capabilities, the competitive terrain will continually shift, introducing new players and technologies that could rewrite the rules. Thus, as you weigh your options, consider the myriad factors at play: market trends, NVIDIA’s enduring innovation, and the strategic moves of rivals actively shaping the future of AI.

As we conclude, remember that the choice to hold or divest is personal, requiring an alignment of your financial goals with your outlook on the tech sector’s trajectory. In an arena as unpredictable as technology, informed decisions are your most reliable compass. Whatever path you choose, may it lead you toward a prosperous future amid the thrilling chaos of the digital age.