In an era where technology and politics intertwine more intricately than ever, the spotlight shifts to Meta—a juggernaut in the world of social media and AI innovation. As the company seeks to redefine the boundaries of artificial intelligence, it finds itself navigating an increasingly complex landscape shaped by the economic ripples of current tariff policies, most notably those introduced during Donald Trump’s presidency. This intersection of corporate ambition and political strategy invites a closer examination of how Meta’s investment in AI is influenced by shifting trade dynamics and regulatory frameworks. In this article, we delve into the nuances of Meta’s spending on artificial intelligence, exploring the implications of tariff policies on its technological pursuits and the broader implications for the industry at large.

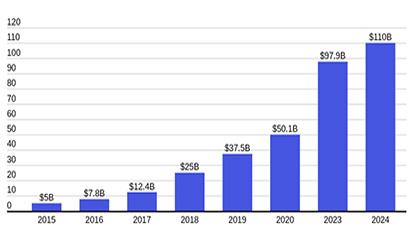

Amid the shifting landscape of economic policies, especially under trump’s tariff initiatives, Meta has strategically redirected its resources towards the burgeoning field of AI technology. This pivot is not merely about staying competitive; it represents a calculated response to external pressures that challenge customary business models.Increasing tariffs on tech imports have made it imperative for companies to innovate domestically, prompting Meta to invest in AI capabilities as a way to enhance operational efficiency and reduce dependency on foreign markets. This approach aligns with a growing trend among tech giants who view artificial intelligence as a critical lever for adapting to the complexities of a potentially restrictive trade surroundings.

In the pursuit of AI excellence,Meta is focusing on several key areas:

The following table highlights some of the most significant implications of these investments, showcasing how meta aims to navigate the economic landscape shaped by evolving tariff policies:

| Investment Area | Impact | Example Initiative |

|---|---|---|

| AI Infrastructure | Enhances processing power | Cloud computing upgrades |

| Data Privacy | Strengthens user trust | Privacy-first AI models |

| Product Development | Drives innovation | AI-driven social features |

As the trade landscape shifts under the weight of tariffs introduced during Trump’s governance, companies like Meta are facing new financial realities. The imposition of tariffs has resulted in increased costs for imported components, which can considerably strain operating budgets.Meta, with its ambitious investments in AI technologies, must now navigate these added financial pressures, assessing how to allocate resources effectively without stunting innovation.Increasing material and operational costs could force Meta to reevaluate its AI expenditure, potentially slowing the pace of development in competitive areas such as machine learning and augmented reality.

Moreover, the implications extend beyond immediate financial challenges. Tariff strategies can create uncertainty in market forecasting,impacting Meta’s planning for future projects. To adapt, Meta might consider strategies such as:

Assessing the macroeconomic environment, it’s essential for Meta to balance cost-cutting measures against the risk of stifling growth and innovation, ultimately determining its long-term position in the evolving digital landscape.

As Meta positions itself at the forefront of AI innovation, the company faces a myriad of challenges intertwined with the political climate, particularly due to Trump’s tariff policies. These tariffs can influence Meta’s operational costs and its ability to invest aggressively in AI technologies. On one hand, these policies could inflate the prices of essential components and infrastructure necessary for AI advancements. On the other,thay potentially provide an prospect for Meta to pivot towards local sourcing,leading to a more lasting and perhaps resilient supply chain. key considerations include:

Furthermore, the current landscape presents opportunities for collaboration and investment in unique AI ventures. While challenges loom, the necessity to adapt can result in groundbreaking innovations that could redefine the market.Meta’s commitment to AI can be demonstrated through strategic investments and partnerships aimed at fostering technological advancements. Critical areas to watch include:

| Opportunity | Description |

|---|---|

| Local AI Talent | Investing in local talent pools can enhance innovation and reduce reliance on foreign imports. |

| AI Startups | Acquiring or investing in startups can catalyze rapid advancements. |

| Sustainable Practices | Developing eco-kind AI systems can align with global sustainability goals. |

As Meta navigates its ambitious AI initiatives within the context of evolving tariffs and economic constraints, it is essential to adopt a multi-faceted strategy that emphasizes both cutting-edge development and fiscal responsibility.Leadership should consider the following approaches:

To further support these recommendations, a clear evaluation of the potential impact of tariffs on operational costs is crucial. A summary table can help in identifying critical financial variables in the context of AI expenditure:

| Factor | Impact Level | Recommended Action |

|---|---|---|

| Tariff Rates | High | Explore Cost-Cutting Measures |

| AI Workforce Costs | Medium | Partnerships for Talent Development |

| Research Funding | Low | Pursue Grants and Sponsorships |

As we navigate the complex landscape of technology and global economics, Meta’s strategic investments in artificial intelligence stand out against the backdrop of evolving tariff policies, particularly those articulated during Trump’s administration. The interplay between innovation and regulation reflects not just the shifting dynamics of international trade, but also the relentless pursuit of advancement within one of the world’s most influential tech giants. As Meta continues to channel resources into AI, its decisions will undoubtedly influence not only its own trajectory but also the broader marketplace and its participants. In a world where technology and policy are intricately woven together, the next chapter in this unfolding narrative promises to be as intriguing as it is indeed consequential. Observers will undoubtedly watch closely, eager to see how these financial commitments reshape the future of both Meta and the industries at large.