In the ever-evolving landscape of technology, few companies have garnered as much attention as Meta Platforms, Inc. Once primarily regarded as Facebook, this Silicon Valley heavyweight has redefined its identity and ambitions in recent years. As investors scrutinize the company’s performance amidst a fluctuating market, recent reports reveal a surprising twist: Meta’s latest revenue figures have exceeded expectations, causing a notable surge in its stock price. This unexpected growth, fueled by strategic shifts and innovative offerings, has sparked renewed optimism among shareholders and analysts alike. As we delve deeper into the factors driving this remarkable performance, we explore what it means for meta’s future trajectory in a competitive digital ecosystem.

Meta’s extraordinary revenue growth can be attributed to several key factors that have come together to boost its financial performance. First and foremost, the enhanced ad targeting capabilities resulting from advanced AI algorithms have attracted advertisers keen on maximizing their return on investment. This precision in targeting allows companies to reach their ideal customers more effectively, driving up demand for ad placements on platforms like Facebook and Instagram. Additionally, an expanded user base across various demographics has led to increased engagement, which in turn fuels the advertising revenue engine by offering advertisers a larger audience base.

Moreover, the diversification of revenue streams has played a pivotal role in Meta’s financial success. The introduction of new monetization options through features such as Stories and Shops has opened avenues for brands to connect with consumers more organically. Additionally, collaborations with e-commerce platforms have facilitated shopping directly through Meta’s apps, further boosting sales. As these innovations take root, the impact is reflected in the financial results, showcasing a robust framework for sustained revenue growth in the face of ongoing market challenges.

Meta’s strategic investments have been pivotal in shaping its current market position, reflecting a proactive approach to adapt and thrive in the ever-evolving tech landscape.As the company diversifies its portfolio, it not only focuses on enhancing its advertising revenue through its core platforms but also invests heavily in emerging technologies, including augmented reality (AR) and virtual reality (VR). These investments are expected to drive future growth and establish Meta as a leader in the metaverse, maintaining engagement with an expanding user base.

In addition, Meta’s commitment to innovation can be seen in its recent partnerships and acquisitions that bolster its infrastructure and service offerings. This strategy is aimed at preserving its competitive edge against rivals. Some notable elements of Meta’s strategy include:

As a testament to its resilience, Meta’s recent stronger-than-expected revenue growth highlights its ability to pivot and respond to market demands, solidifying investor confidence and paving the way for sustained success.

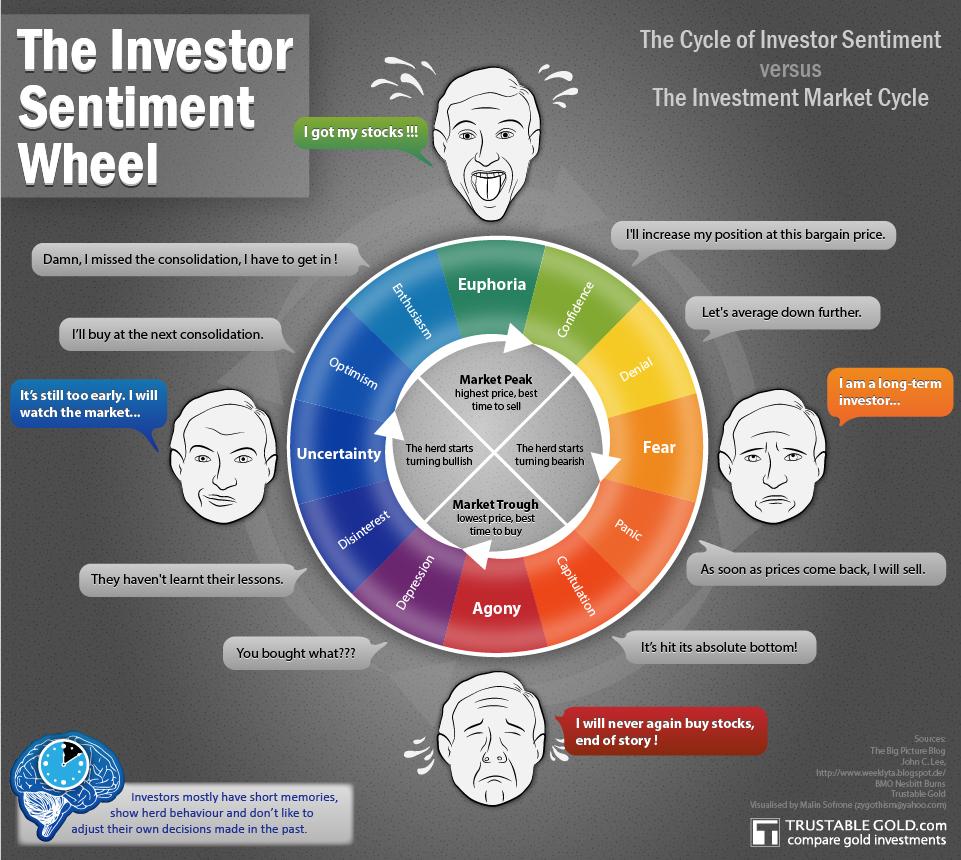

After a robust quarterly performance, investor sentiment towards Meta has shifted considerably. The better-than-expected revenue growth has not just reinstated confidence among existing shareholders, but also attracted attention from potential investors looking for stable returns in the tech sector. This shift in sentiment can be attributed to several key factors:

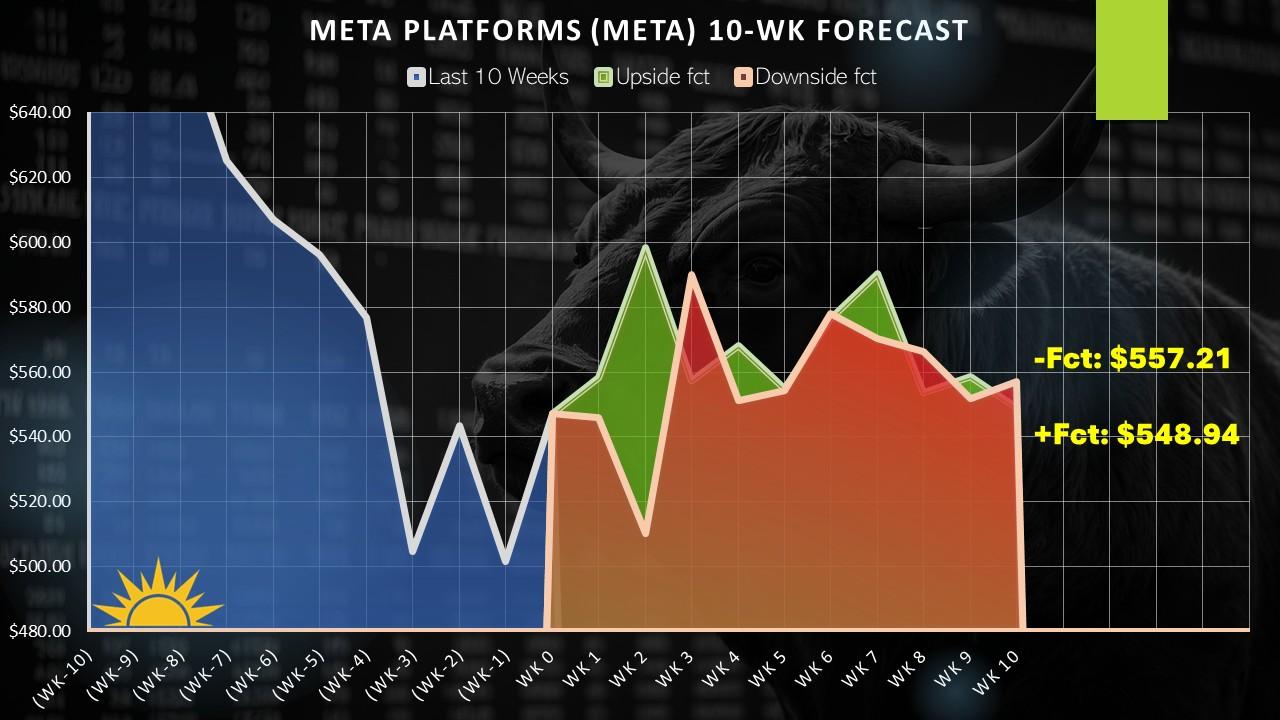

Looking forward, the growth prospects for Meta appear promising, driven by strategic investments in AI and virtual reality. As the company expands its advertising capabilities and diversifies its revenue streams, the potential for long-term value creation becomes evident. An analysis of future performance can be summarized as follows:

| Key Indicators | Current Value | Projected Growth (Next 12 months) |

|---|---|---|

| Revenue Growth Rate | 25% | 30% |

| Active Users | 3.5 billion | 4 billion |

| Investment in R&D | $20 billion | $25 billion |

When considering investments in Meta stock, it’s essential to adopt a strategic approach that maximizes potential gains while minimizing risks. One method to effectively navigate this landscape is by closely monitoring the company’s quarterly earnings reports and market trends. Pay particular attention to key performance indicators such as user growth, ad revenue, and engagement levels. these factors often serve as strong predictors of future performance and can help guide your timing for entry or exit from your investment. Additionally, diversifying your portfolio by incorporating stocks from various sectors can mitigate volatility associated with fluctuations in Meta’s stock price.

Implementing risk management techniques is also crucial for successful navigation of Meta stock investments. Setting clear stop-loss orders can protect against meaningful downturns by automatically selling shares when they reach a pre-determined price. It’s also wise to establish investment goals and maintain a disciplined approach to avoid emotional decision-making during periods of market turbulence. Engaging with financial analysis tools and staying informed about industry developments can further enhance your investment acumen. Consider utilizing the following strategies:

| Aspect | Tips |

|---|---|

| Market Trends | Regularly review Meta’s latest news and reports. |

| Risk Management | Set stop-loss orders based on your risk tolerance. |

| Portfolio Diversification | Balance your investments with stocks from different sectors. |

In the ever-evolving landscape of technology and digital connectivity, Meta’s latest revenue growth serves as a compelling reminder of the company’s resilience and strategic adaptability. With a performance that defied market expectations, Meta not only reaffirms its place in the competitive arena but also offers a glimpse into the potential that lies ahead as it embraces innovation and expansion. As investors digest this positive development, the broader implications for the tech sector become evident—demonstrating that even amidst challenges, there are opportunities for revival and growth. As we move forward, all eyes will be on Meta to see how they leverage this momentum and navigate the currents of change in the digital age. The company’s journey is far from over, and its story continues to unfold with each quarterly report.