In the ever-evolving landscape of technology and digital innovation, the stock market often serves as a barometer for investor sentiment and corporate performance. Meta Platforms Inc., the parent company of Facebook, Instagram, and WhatsApp, has recently captured the attention of market watchers as its stock extends a robust rally following an unexpected upswing in its Q1 earnings. Surpassing analysts’ projections, the tech giant’s latest financial report not onyl highlights its resilience amidst fierce competition but also reinforces its pivotal role in shaping the digital economy. As investors weigh the implications of this earnings surprise, we delve into the factors driving Meta’s stock performance and what this means for the future of the company in a rapidly changing market.

Meta has onc again proven its resilience with a remarkable performance in the first quarter, captivating investors and analysts alike. The tech giant’s earnings report shattered expectations, showcasing a solid growth in revenue driven by renewed advertising momentum and strategic investments in its metaverse initiatives.Key highlights from the report include:

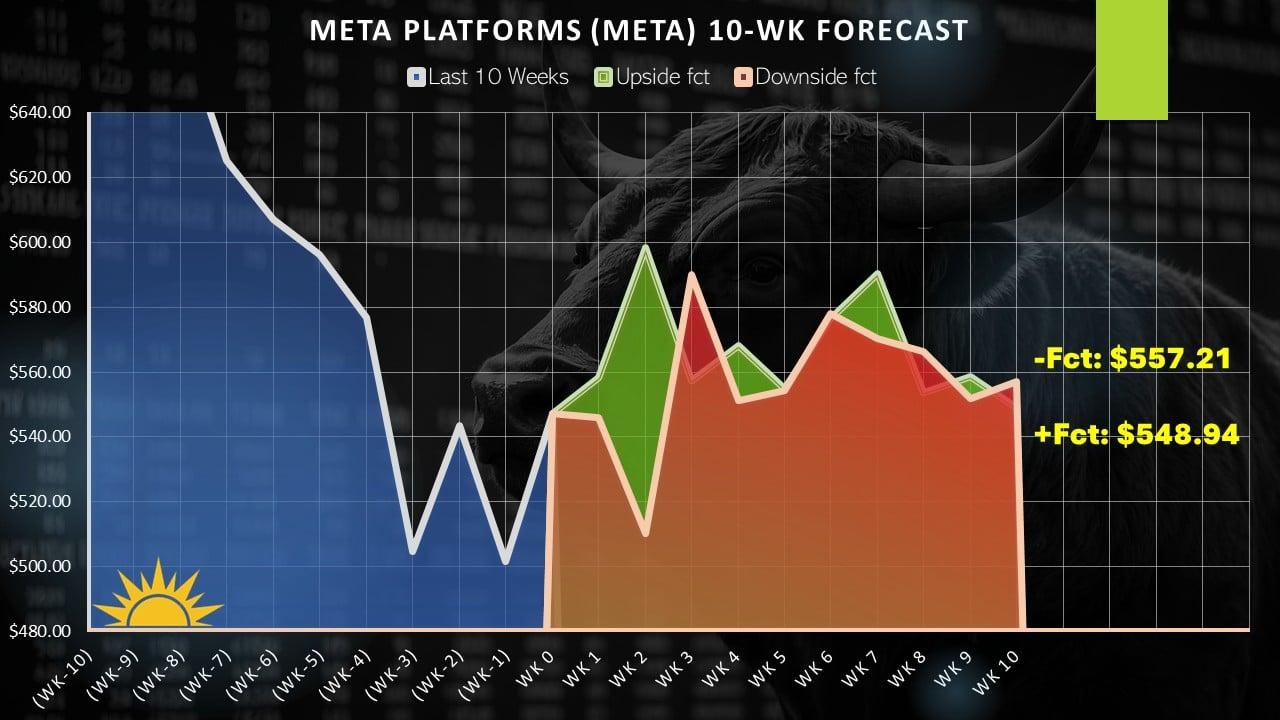

As a result, the stock saw a important boost in value, extending its rally into a second consecutive day. Investors have responded enthusiastically,eager to capitalize on meta’s renewed vision and commitment to innovation. A closer look at the stock performance post-earnings reveals:

| Date | Stock Price Change (%) | Closing Price ($) |

|---|---|---|

| Day 1 | 5.3 | 275.50 |

| Day 2 | 3.1 | 284.50 |

With these impressive figures, Meta is not just overcoming challenges but strategically positioning itself for future growth, making it a compelling option for investors seeking exposure to the tech sector’s evolving landscape.

Meta’s unexpected earnings report has once again highlighted the factors propelling its financial success.Several key components contributed to this significant surprise, underscoring the resilience of its buisness model in an ever-evolving digital landscape.Among these drivers, the following stand out:

The integration of emerging technologies, such as AI-driven advertising solutions, has also played a crucial role. These innovations have not only enhanced targeting capabilities but also improved user experience,resulting in higher conversion rates and advertiser satisfaction. A simplified view of these financial dynamics can be illustrated in the table below:

| Key Metrics | Q1 2023 Results |

|---|---|

| Revenue Growth | +20% |

| Active Users | 2.96 Billion |

| Operating Margin | 35% |

The unexpected surge in Meta’s stock price following its Q1 earnings announcement has sparked a wave of optimism among investors. As the market digests the implications of the company’s performance, several key factors contribute to the prevailing sentiment:

This upbeat mood is reflected not just in Meta’s stock chart but also across broader market indices. As a result, several analysts have revised their ratings, encouraging a positive feedback loop among investors.Here’s a snapshot of analyst recommendations post-earnings:

| Firm | Previous Rating | New Rating | Target Price |

|---|---|---|---|

| Goldman Sachs | Hold | Buy | $350 |

| Morgan Stanley | Neutral | Overweight | $360 |

| BofA Securities | Underperform | Neutral | $340 |

As investors weigh these factors meticulously, the overall sentiment in the market has shifted toward optimism, suggesting that Meta’s stock could maintain its upward momentum in the days ahead.

The recent surge in Meta’s stock price following an unexpected earnings beat highlights the potential for investors looking to capitalize on emerging trends in technology and digital advertising. As the company continues to pivot its focus toward AI integration and virtual reality platforms, stakeholders should consider the following key factors:

Furthermore, assessing the broader economic context is crucial for potential investors. The ongoing shift toward digital ecosystems may provide a ripe opportunity for growth. Understanding Meta’s ability to adapt to regulatory challenges and shift in consumer preferences can offer valuable insights. Below are some performance indicators to monitor:

| Performance Indicator | Current Value | Last Quarter |

|---|---|---|

| Stock Price Growth | $320 | $280 |

| P/E Ratio | 21 | 18 |

| Forward Earnings Growth | 10% | 8% |

As the dust settles from Meta’s impressive earnings surprise,the stock’s continued rally underscores the market’s optimism and investors’ enthusiasm. With innovation at the forefront and strategic pivots in play, meta’s journey toward redefining its role in the digital landscape remains compelling. As analysts sift through the numbers and gauge future implications, the tech giant’s performance will undoubtedly remain a hot topic among investors. For now, the extension of this rally serves as a reminder of the ever-evolving nature of technology investments and the potential rewards for those willing to stay engaged. As we keep an eye on the unfolding narrative, it will be fascinating to watch how Meta navigates the challenges ahead and capitalizes on new opportunities in the digital realm.