In a rapidly evolving digital landscape, where artificial intelligence is not just a buzzword but a fundamental pillar driving innovation, few companies evoke as much intrigue as Meta Platforms (NASDAQ: META). Despite the market’s relentless pursuit of the next big tech miracle, Meta has quietly positioned itself as a powerhouse in the AI domain, frequently enough overlooked in favor of flashier names. This article dives into the multifaceted layers of Meta’s business model, exploring why this tech giant stands out as one of my favorite undervalued investments in the AI sector. By examining its strategic initiatives,robust technological foundation,and glimpses of its future potential,we’ll unravel the narrative behind Meta’s promising trajectory in the realm of artificial intelligence.Join me as we take a closer look at what makes this company a compelling opportunity for investors seeking to capitalize on the AI revolution.

In the constantly evolving landscape of technology, few companies exhibit the transformative potential of Meta Platforms. With a robust portfolio of innovative tools and solutions, Meta is positioning itself at the forefront of artificial intelligence advancements. This isn’t just about social media; it’s about harnessing cutting-edge technologies to enhance user experience and operational efficiency. Some key factors that set Meta apart include:

Moreover, Meta’s strategic moves into the metaverse represent a vast opportunity for AI to reshape digital interaction. The company is not merely a participant in the tech sector; it’s a pioneer exploring new terrains where AI can redefine user engagement. Consider the following table that illustrates some AI initiatives within the company:

| AI Initiative | description | Expected Impact |

|---|---|---|

| Natural Language Processing | Enhancing communication through improved language understanding. | Increased customer satisfaction and interaction. |

| Computer Vision | Identifying and categorizing content for better moderation. | Safer online environments and streamlined content delivery. |

| Augmented Reality | Creating immersive experiences for users in the metaverse. | Revolutionizing user engagement and brand marketing. |

In examining Meta’s financial landscape, several key growth metrics stand out, painting a hopeful picture for potential investors. The company has demonstrated a consistent increase in revenue streams,largely fueled by its strong performance in advertising and the burgeoning demand for AI-powered solutions. Recent quarterly reports revealed that advertising revenue had increased by over 20% year-over-year, showcasing the effectiveness of its targeted ad algorithms. Furthermore, the integration of AI capabilities across its platforms has not only enhanced user engagement but has also unlocked new monetization avenues.

Another notable aspect is the growth in monthly active users (MAUs), which has steadily risen, reflecting Meta’s successful initiatives to retain and attract new users.The company recently reported a MAU increase of approximately 10% compared to the previous year, a testament to its evolving strategy. To better illustrate the company’s progress, consider the following metrics:

| Metric | current Value | Year-over-Year Change |

|---|---|---|

| quarterly Revenue | $33.67 Billion | +20% |

| Monthly Active Users | 3.58 Billion | +10% |

| EPS (Earnings per Share) | $3.19 | +15% |

By focusing on thes critical metrics,investors can gauge Meta’s resilience in a competitive market while recognizing its potential for future expansion. The steadfast growth in both user engagement and revenue generation not only reinforces meta’s strong market position but also marks it as a prime candidate for investment in the ever-evolving AI landscape.

At the forefront of technological advancement, Meta Platforms is leveraging its resources to pioneer transformative AI initiatives that promise to redefine user engagement and interaction across its platforms. With a focus on developing refined machine learning algorithms, meta is enhancing content personalization, making it easier for users to discover relevant data, products, and connections. This push not only optimizes the user experience but also significantly boosts advertising efficacy for businesses, creating a win-win situation in the marketplace.Some key areas of innovation include:

As Meta continues to invest heavily in research and development, its AI ecosystem fosters a landscape ripe for opportunities. By promoting ethical AI practices and openness, the company is not only building trust within its user base but also setting benchmarks for industry standards. Looking ahead, the strategic implementation of AI technology will be pivotal in driving meta’s revenue growth and maintaining its competitive edge. Key anticipated impacts include:

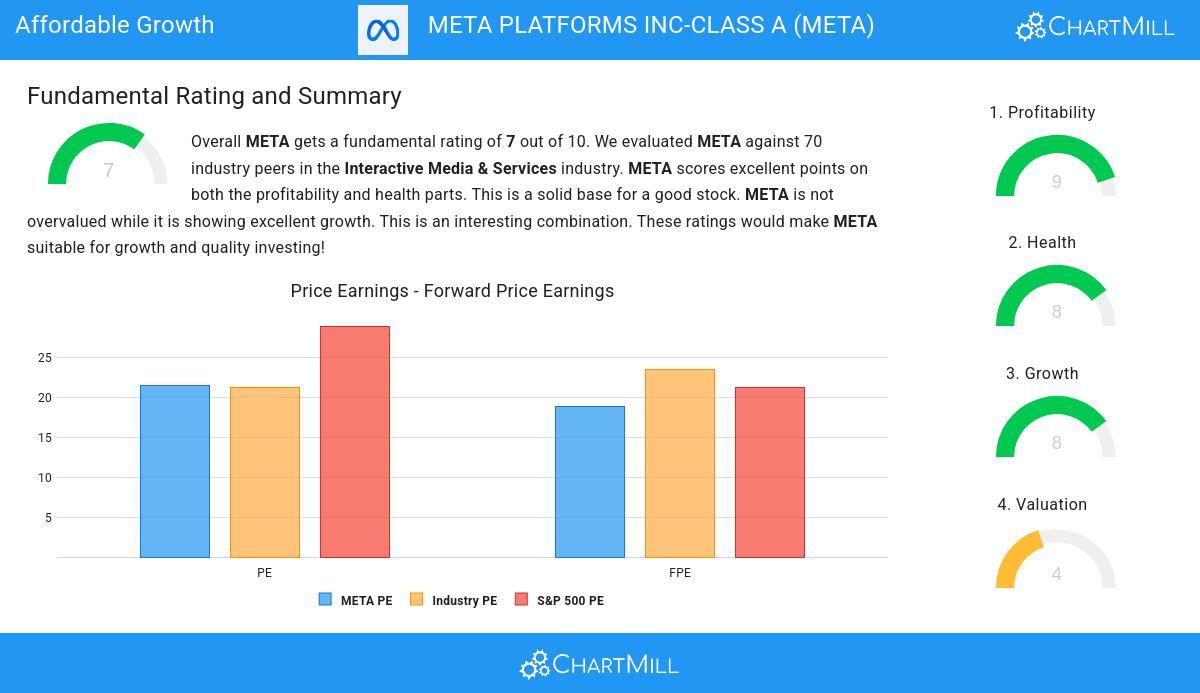

As investors navigate the evolving landscape of technology stocks, Meta Platforms emerges as a compelling opportunity, particularly in the realm of artificial intelligence. The company has consistently shown its ability to innovate and adapt, positioning itself at the forefront of AI development. With its significant investments in machine learning and data analytics, Meta not only enhances its platform offerings but also opens new revenue streams that can led to long-term growth. This makes it an attractive proposition for those looking to diversify their portfolios with cutting-edge technology.

several factors bolster the case for including Meta in your investment strategy:

The table below highlights some recent metrics showcasing Meta’s performance:

| Metric | Q2 2023 | Q3 2023 |

|---|---|---|

| Revenue ($ Billion) | 32 | 34 |

| monthly Active Users (Million) | 2,960 | 3,010 |

| AI Investment ($ Billion) | 5 | 6 |

Meta Platforms (NASDAQ: META) stands at the captivating intersection of innovation and opportunity, presenting itself as a compelling investment choice for those keen on tapping into the burgeoning potential of artificial intelligence. While the shadows of skepticism may linger, the company’s commitment to redefining the boundaries of technology is evident. As we navigate an evolving digital landscape, investors who recognize the intrinsic value and strategic foresight of Meta could find themselves well-positioned for the future.

As we chart our course through the complexities of the investment world, remember that undervalued gems like Meta may hold the key to unlocking significant returns. With the right outlook and a keen understanding of the market dynamics at play, this tech giant could very well rise to exceed expectations and inspire a new era of growth. So, as you weigh your options, consider the role that Meta Platforms may play in your portfolio—an intriguing prospect worth keeping an eye on as we forge ahead into an AI-driven tomorrow.