In the dynamic world of tech investments, few names evoke as much intrigue as Meta Platforms, Inc. As the parent company of social media giants like Facebook and Instagram, Meta has consistently been at the forefront of digital innovation. However, recent reports indicate a meaningful shift in the company’s financial landscape, with capital expenditures projected to rise steeply. This shift raises critically importent questions for investors: How will these increased investments impact free cash flow forecasts, and what does this mean for Meta’s stock valuation? As the company pivots towards ambitious projects in virtual and augmented reality, it’s crucial to analyze whether these expenditures will yield long-term benefits or signal potential risks. In this article, we delve into Meta’s evolving financial strategy, explore the implications of rising capex, and ultimately assess whether now is the right time to buy into META stock.

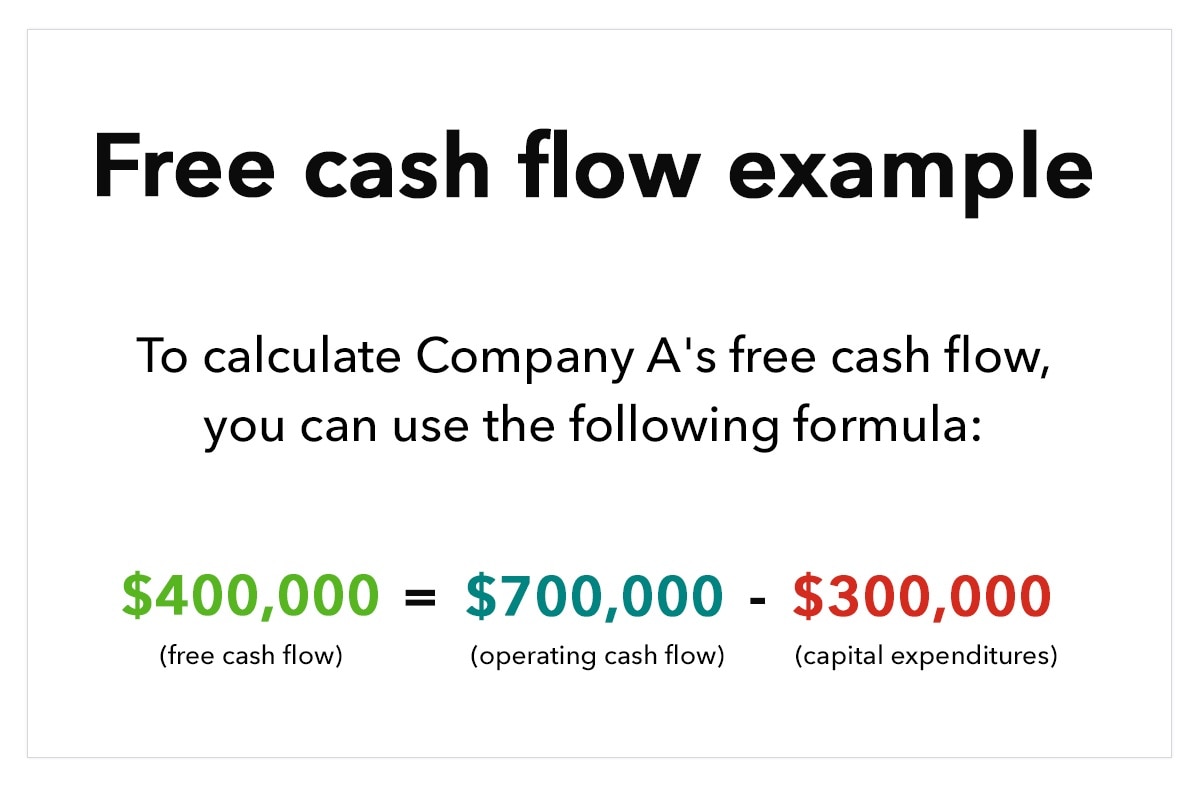

the rise in capital expenditure (capex) for Meta Platforms is a significant factor that investors must consider when evaluating its financial stability and future growth potential. As the company directs more funds towards technology advancements, metaverse progress, and infrastructure improvements, it’s essential to weigh the potential benefits against the implications for free cash flow (FCF). Increased investment may initially compress FCF but could lead to long-term growth through enhanced operational efficiencies and market expansion. Shareholders should ponder the following points:

Moreover, to assess Meta’s financial health accurately, it’s prudent to analyze the correlation between rising capex and key financial metrics.A deeper look into projected earnings alongside estimated FCF can provide clarity on whether the stock remains a viable investment option. Here’s a simplified view:

| Year | Projected Capex | Estimated FCF |

|---|---|---|

| 2023 | $30 billion | $10 billion |

| 2024 | $35 billion | $8 billion |

| 2025 | $40 billion | $12 billion |

Investors looking at Meta Platforms must carefully consider the implications of rising capital expenditures on free cash flow projections. As the company shifts focus towards enhancing its infrastructure and investing in technology advancement,the operational landscape is evolving. This surge in spending is expected to considerably impact FCF, prompting a reassessment of what the company can afford to return to shareholders.Key factors to note include:

Given these rising expenditures,projections for free cash flow could indeed see downward adjustments. The impact of these changes can be better illustrated in the table below, highlighting the correlation between capital expenditures and expected FCF:

| Year | Capital Expenditures (in Billions) | Expected Free Cash Flow (in Billions) |

|---|---|---|

| 2023 | $30 | $15 |

| 2024 | $38 | $10 |

| 2025 | $45 | $5 |

The outlook provided by these figures demonstrates a clear trend: as Capex increases, free cash flow is pressured, raising questions about whether the current market price reflects Meta’s potential growth. As investors evaluate META stock,understanding the balance between expenditure and revenue generation will be critical for informed decision-making.

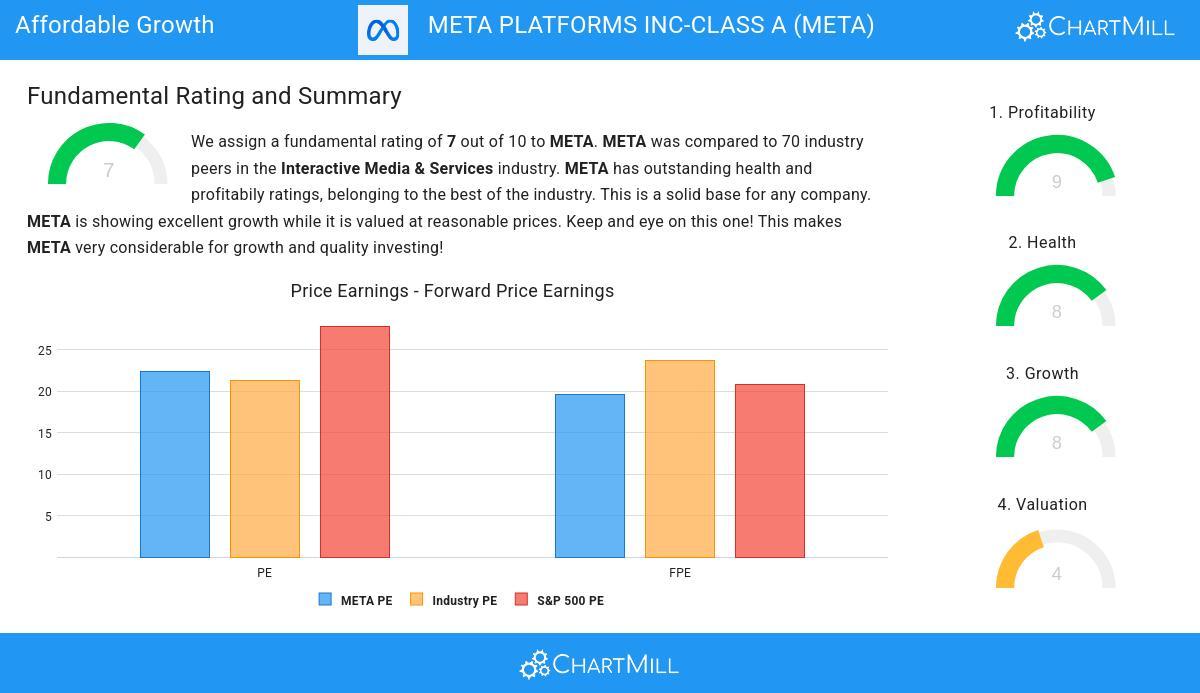

As Meta Platforms steers towards a significant increase in its capital expenditures,there are several implications that investors need to contemplate regarding stock valuation.The rise in capex is likely to stem from ventures into augmented reality, virtual reality, and advancements in its social media services. This change indicates a strategic pivot towards long-term growth, albeit at the expense of immediate free cash flow (FCF) projections. Analysts suggest that with higher investments, short-term profitability could take a hit, which may reflect negatively in valuation metrics traditionally employed by investors. The resulting factors include:

However, it’s crucial to analyze how these shifts might affect the company’s competitive positioning in the tech sector. The long-term benefits of enhanced capabilities could outweigh the initial drawbacks of reduced cash flow.For instance, a careful assessment of fundamental metrics such as price-to-earnings (P/E) and enterprise value-to-EBITDA ratios might reveal an undervalued stock in the backdrop of its ambitious growth trajectory.Below is a comparative outlook based on recent financial data that highlights key value indicators:

| Metric | Current Value | Industry Average |

|---|---|---|

| Price-to-Earnings (P/E) Ratio | 26 | 30 |

| Enterprise Value/EBITDA | 14 | 16 |

| dividend Yield | 1.5% | 2.0% |

Investors are currently weighing the implications of Meta Platforms’ rising capital expenditures (capex), which are anticipated to impact future free cash flow (FCF) forecasts. As the company embarks on significant investments in virtual reality and metaverse technologies, understanding the potential long-term benefits versus short-term costs becomes crucial. The increase in capex could result in reduced FCF in the near term, leading some investors to question whether this is a temporary setback or a strategic pivot towards future growth opportunities.

When considering an investment in META stock, it’s essential to evaluate several factors that could influence the company’s trajectory and stock price:

| Factors | Impact on META |

|---|---|

| Increased Capex | Short-term reduction in FCF |

| Metaverse Investment | Potential long-term growth |

| Market Sentiment | Fluctuations in stock price |

| Competitive Moves | Pressure on pricing and innovation |

as we navigate the evolving landscape of Meta Platforms,it becomes increasingly clear that the company’s heightened capital expenditures signal a strategic pivot towards innovation and growth. While this rise may temper free cash flow forecasts in the short term, it also underscores a commitment to long-term sustainability and competitiveness in an ever-changing digital universe. Investors will need to weigh these factors carefully, balancing the immediate implications of rising capex against the potential for future returns. As the market continues to react to Meta’s ambitions and adaptations,the question remains: Is META stock a worthy addition to your portfolio? Only time will tell,but staying informed and agile will be key in making that decision.