In a stunning turn of events that has reshaped the tech landscape,Meta and Microsoft have posted robust earnings reports,lighting the way for a new era of growth and innovation in the digital sphere. As both companies navigate the complexities of an ever-evolving market, these notable financial results have catapulted Microsoft back to its position as the world’s largest company, a crown it last donned years ago. In this article, we delve into the key drivers behind these financial successes, exploring the strategic maneuvers and technological advancements that are fueling their ascent. With the rivalry between these two giants intensifying, the implications for investors, consumers, and the industry at large are profound and far-reaching.Join us as we unpack the numbers and nuance behind this critically important moment in corporate history.

The remarkable surge in the stock performance of leading technology companies this quarter is not merely a fleeting moment of success but a reflection of underlying strengths that have been reinvigorating investor confidence. Meta’s strong earnings report, showcasing impressive growth in user engagement and advertising revenue, coupled with Microsoft’s stellar results, has created a wave of optimism. Investors are particularly drawn to Microsoft’s strategic investments in AI technology, which not only bolstered their revenues but also positioned them as a leader in a rapidly evolving market. This dynamic resurgence has seen Microsoft reclaim its title as the world’s largest company, invigorating discussions about its long-term prospects and stability.

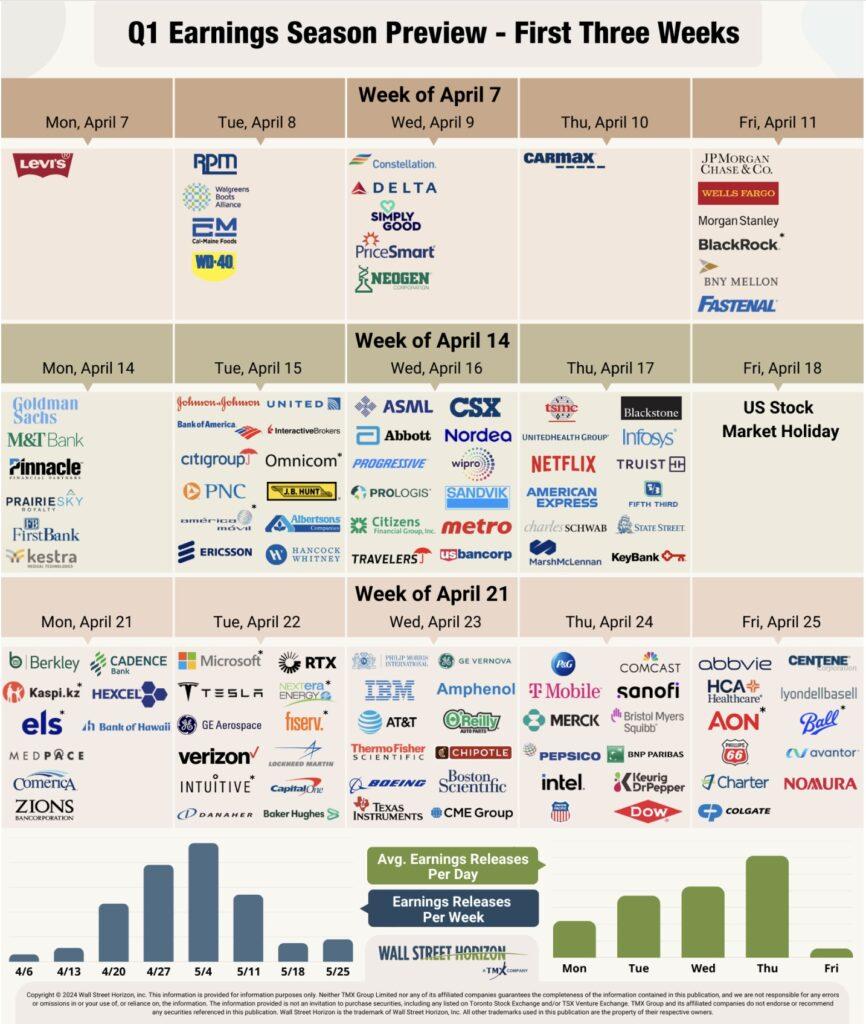

As we delve deeper into the financials, the numbers reveal a story of resilience and adaptability amidst economic uncertainty. Both companies have demonstrated a keen ability to pivot in response to market demands, emphasizing innovation and efficiency. here’s a snapshot of key financial metrics that underline this tech renaissance:

| Company | Quarterly Revenue | Year-Over-Year Growth |

|---|---|---|

| Meta | $32 billion | +23% |

| Microsoft | $56 billion | +17% |

Amid these remarkable financial performances, investor sentiment remains buoyant, as the tech sector not only demonstrates resilience but also sets the stage for future growth in emerging technologies. With such robust earnings underscoring their competitive edge, the confidence in these tech giants is palpable, positioning them as stalwarts in the global market landscape.

Despite a backdrop of market uncertainty, Meta and microsoft have delivered impressive financial results that have delighted investors. meta, propelled by its robust advertising revenue and a renewed focus on its metaverse strategy, showcased a remarkable year-on-year growth that far exceeded analysts’ expectations. Furthermore, the company’s efforts to optimize user engagement and streamline operational costs have translated into enhanced profit margins, signaling a promising roadmap ahead.

On the other hand, Microsoft has effectively reclaimed its title as the world’s largest company, driven primarily by its cloud computing division and strong software sales. The quarterly earnings report revealed significant growth in Azure services, which continue to capture market share and customer loyalty. As businesses increasingly migrate to cloud solutions, Microsoft’s resilience in these turbulent times stands as a testament to its strategic positioning and innovative capabilities. Key highlights from both companies include:

The recent earnings reports from Meta and Microsoft have provided a treasure trove of strategic insights for investors. Meta showcased impressive growth in user engagement and advertising revenue, which is pivotal given the competitive landscape of digital marketing. Key takeaways include:

On the other hand,Microsoft’s robust performance solidified its position as the world’s largest company,showcasing the power of diversification in its business model. Their strategic focus on cloud computing and AI-driven services has paid dividends, illustrated by the following points:

| Company | earnings Growth (%) | Key Strategy |

|---|---|---|

| Meta | 35% | Enhanced User Engagement |

| Microsoft | 30% | Cloud and AI Solutions |

The competitive landscape of the tech sector continues to evolve,especially as industry giants like Meta and Microsoft demonstrate resilience through impressive earnings reports. The recent surge in their stock prices underscores a positive sentiment among investors, signaling a renewed confidence in their long-term strategies. Companies are now focusing on innovative technologies, such as artificial intelligence and cloud computing, which are pivotal for driving future growth. Key opportunities for businesses in this surroundings include:

As Microsoft reclaims its status as the world’s largest company, its business strategies provide valuable lessons on adaptability and growth in a fast-paced industry. Understanding the shifts in consumer behavior and technological advancements is crucial for remaining competitive.Companies must prioritize innovation while maintaining their core values to navigate the challenges ahead. The table below summarizes insights into earnings growth among key players:

| Company | Q3 Earnings Growth (%) | Market Cap ($ Billion) |

|---|---|---|

| Meta | 12 | 475 |

| Microsoft | 14 | 2,550 |

| 9 | 1,580 |

In a landscape where innovation thrives and competition intensifies, the recent earnings reports from Meta and Microsoft mark a significant chapter in the ongoing narrative of the tech industry.With Meta demonstrating resilience and adaptability, and Microsoft reclaiming its title as the world’s largest company, both giants have set the stage for a new wave of growth and creativity. As they navigate the complexities of market demands and consumer expectations, these companies not only reflect the dynamism of technology but also illustrate the power of strategic foresight and execution. As we look ahead, it will be intriguing to witness how these corporate titans continue to shape the digital world, inspiring others to follow their lead and innovate. The future is undoubtedly bright for those poised to embrace change in this ever-evolving arena.