In an unexpected twist that has captured the attention of investors and analysts alike, Meta Platforms, Inc. (META) has exceeded Wall Street expectations for the first quarter, thanks in large part to a surge in advertising revenue driven by artificial intelligence innovations. With a remarkable windfall of $42 billion, the tech giant not only demonstrated its resilience in an evolving digital landscape but also showcased the transformative power of AI in reshaping advertising strategies. As businesses increasingly turn to technology to enhance workflow and engagement, Meta’s extraordinary financial report offers a window into the future of advertising—and perhaps a glimpse of what lies ahead for technology and media giants in a world rapidly adapting to artificial intelligence. In this article, we delve into the factors behind Meta’s stellar performance, the role of AI in its advertising success, and what it might mean for the industry at large.

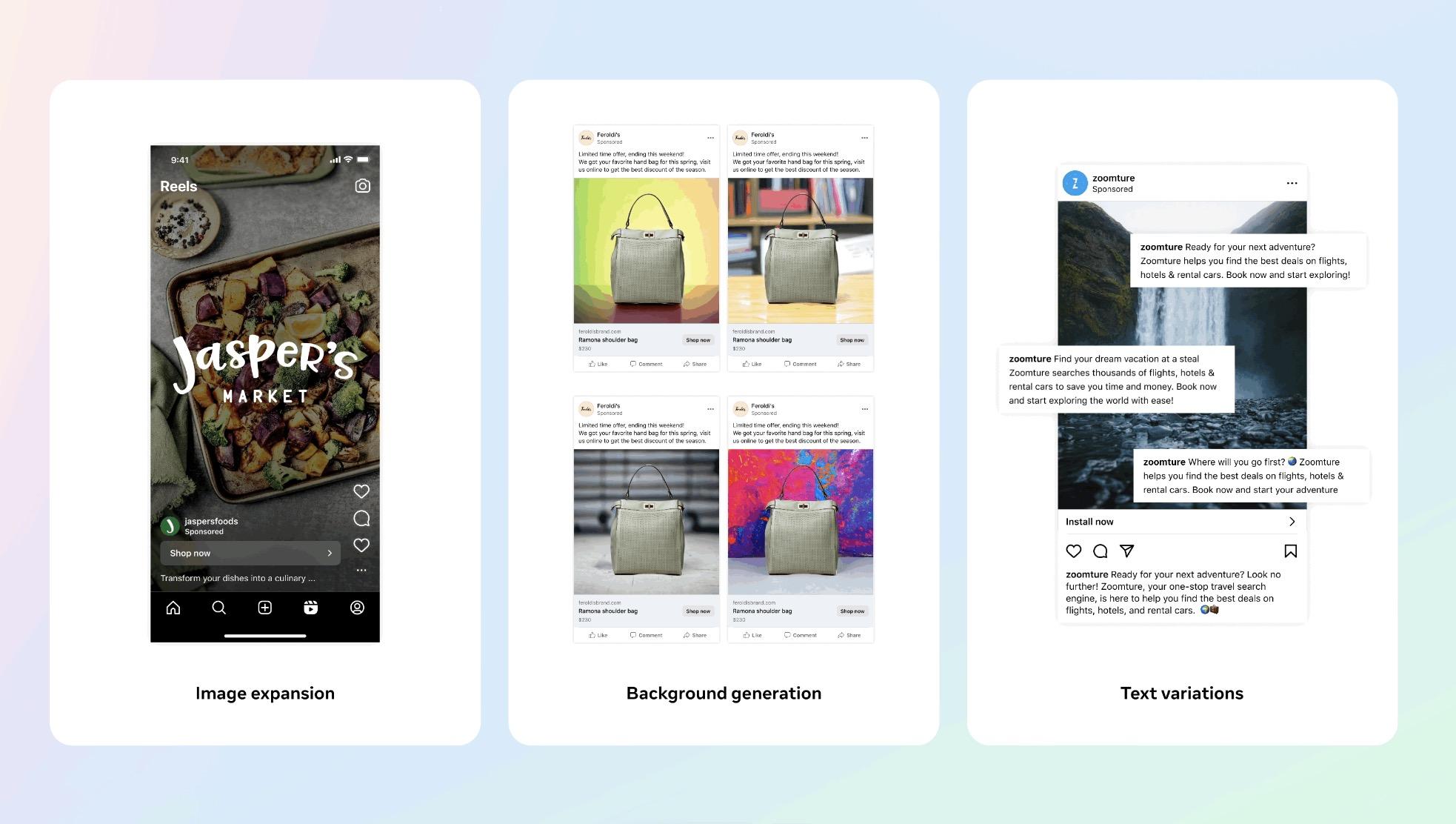

Meta has achieved remarkable results in the first quarter, significantly exceeding expectations with earnings that skyrocketed to an impressive $42 billion. This surge is largely attributed to the company’s innovative leverage of artificial intelligence (AI) within its advertising strategy. By harnessing AI technologies, Meta has refined its targeting capabilities, enabling advertisers to reach thier desired audiences more effectively.Consequently, businesses are experiencing higher engagement rates and conversion metrics, creating a cycle of demand that propels Meta’s revenue growth. Key elements of this AI-driven approach include:

The impact of AI on Meta’s advertising isn’t just limited to immediate financial gains; it represents a paradigm shift in how digital marketing will evolve. With AI at the core of its strategy, Meta is not only enhancing its platform’s efficiency but also setting new standards for user experiance and advertiser satisfaction. Looking forward, the integration of AI tools is expected to continue shaping the landscape of social media marketing, prompting a broader shift in how brands approach consumer engagement and advertising strategies.

| Key Metrics | Q1 2023 | Q1 2022 |

|---|---|---|

| Revenue | $42 billion | $27 billion |

| Net Income | $12 billion | $5 billion |

| Ad Revenue Growth | 50% | 15% |

The recent $42 billion windfall for Meta can be attributed to a confluence of several strategic factors that have propelled the tech giant beyond market expectations. Key among these is the rapid evolution of artificial intelligence (AI),which significantly enhanced their advertising capabilities. With AI-driven tools,Meta has not only improved ad targeting but has also streamlined content creation,allowing for more personalized user experiences. The impacts of this innovation are profound,as seen in:

Moreover, the surge can also be linked to Meta’s proactive approach in diversifying its revenue streams. The firm has strategically solidified its presence in emerging markets, capitalizing on the growing number of internet users and advertisers looking for accessibility. This diversification is essential, as outlined in the table below, which illustrates Meta’s revenue growth across different sectors:

| Sector | Q1 Revenue Growth (%) |

|---|---|

| Digital Advertising | 30% |

| Marketplace & E-commerce | 25% |

| Virtual Reality & Metaverse | 15% |

The remarkable success of Meta’s AI-driven advertising strategy underscores significant opportunities for businesses to transform their own marketing initiatives. With advertising revenues hitting an impressive $42 billion, companies can take notes from Meta’s playbook to harness the potential of advanced AI technologies. By integrating AI tools into their marketing workflows, businesses can achieve higher engagement rates and increased conversion through more personalized ad experiences. This can be accomplished by utilizing data analytics to understand consumer behavior better, which allows for targeted advertising that resonates with the right audience at the right time.

Additionally, companies should consider training their teams to utilize AI-powered platforms that facilitate smoother ad placement and track success metrics. This investment in technology not only improves efficiency but also aligns with contemporary consumer expectations of personalization and relevance.A focused strategy that incorporates AI can yield remarkable returns, similar to those seen by Meta, making it imperative for forward-thinking businesses to adapt rapidly in this evolving digital landscape. Consider the following benefits:

| Benefit | Description |

|---|---|

| Cost Efficiency | AI helps reduce overhead by automating manual tasks. |

| Increased ROI | AI-targeted campaigns can lead to higher returns on ad spend. |

| Scalable Solutions | AI tools can be scaled across various platforms for wider reach. |

Investors looking to capitalize on Meta’s impressive growth should consider a multi-faceted approach to maximize their returns. With the company’s recent foray into AI-driven advertising, there are several strategies that can be pursued:

Additionally, consider leveraging various financial instruments to amplify potential gains. Depending on your risk tolerance,tools such as options trading or ETFs that focus on tech stocks can provide additional avenues:

| Instrument | Potential Benefit | risk Level |

|---|---|---|

| Options Trading | High returns on investment | High |

| Tech-Focused ETFs | Diversification with lower risk | Medium |

| Direct Stock Purchases | Full exposure to Meta’s growth | Medium-high |

As we draw the curtain on Meta’s impressive Q1 performance,it’s clear that the integration of artificial intelligence into their advertising model has proven to be a game changer. Surpassing estimates with a remarkable $42 billion windfall,Meta stands at the crossroads of innovation and profitability,setting the stage for future growth in an ever-evolving digital landscape. While the road ahead may be dotted with challenges, the company’s ability to leverage cutting-edge technology for revenue generation signals a strong potential for sustained success. In a world where data drives decisions, meta’s latest financial results remind us that adaptability and innovation are paramount. As we continue to observe the interplay between technology and market dynamics, one thing is certain: Meta’s journey is one to watch.