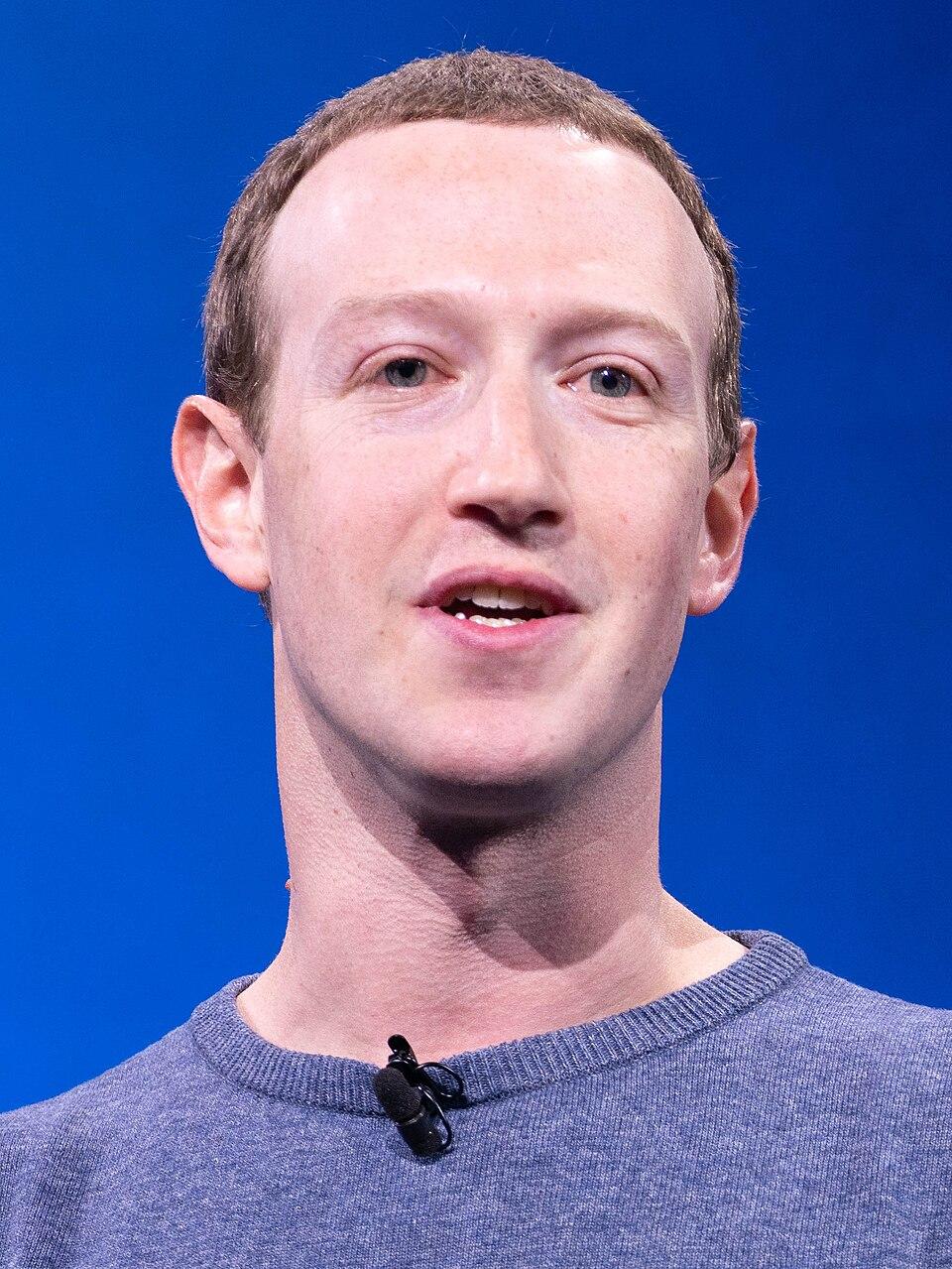

In the ever-evolving landscape of cryptocurrencies, whispers and rumors are as common as price fluctuations. Yet, when a leak surfaces hinting at potential maneuvers from tech mogul Mark Zuckerberg to influence the bitcoin market, the buzz intensifies. with Facebook’s (now Meta’s) foray into the digital currency realm through initiatives like Diem and the Metaverse,the intertwining of social media giants and cryptocurrency has never been more intriguing.This article delves into the nuanced implications of the recent leak, exploring whether Zuckerberg’s actions could indeed set the stage for a seismic shift in Bitcoin’s value and the broader crypto ecosystem. As we sift through the facts and implications, we aim to uncover the motivations behind this potential power play, and what it could meen for the future of digital assets.

Recent whispers from within the industry suggest that Mark Zuckerberg is not just watching the crypto landscape; he’s poised to disrupt it. As the architect of a socio-digital juggernaut, Zuckerberg recognizes the power of blockchain and cryptocurrencies to transform not only financial transactions but also the very fabric of social interaction. This strategic interest may manifest in various ways, including potential collaborations with established crypto firms or the development of Meta’s own digital currency. The implications are important, with the capability to perhaps drive Bitcoin prices and the crypto market to unprecedented heights.

Industry analysts are keenly observing the following factors that could indicate Zuckerberg’s next move:

| Potential Impacts | Bitcoin Price Influence |

|---|---|

| Increased User Adoption | +25% Growth |

| enhanced Market Visibility | +15% Surge |

| New Investment Channels | +30% Boost |

as Mark Zuckerberg quietly shapes his vision for the future of cryptocurrency, the implications for Bitcoin valuations are significant. His potential strategies could leverage TikTok-like engagement and societal trends, drawing in a new generation of investors enamored with digital assets.If these plans materialize, we could witness a rapid influx of capital into Bitcoin, pushing its value to unprecedented heights. The ripple effects may lead to an environment were mainstream adoption becomes inevitable,reshaping how both investors and regulators view cryptocurrency markets.

The foundations of Zuckerberg’s ambitions seem centered around three core elements: interoperability, consumer trust, and scalability. By enhancing the utility of blockchain platforms, Zuckerberg can provide a seamless user experience, further integrating cryptocurrency into daily life. As the market reacts to his moves, it could facilitate increased acceptance among businesses and consumers alike. Below is a brief overview of how these enhancements could directly impact Bitcoin:

| element | Potential Impact on Bitcoin |

|---|---|

| Interoperability | Increased user adoption leading to higher demand |

| Consumer Trust | Greater stability in market values, reducing volatility |

| Scalability | Ability to handle larger transactions, appealing to investors |

The recent revelations about Mark Zuckerberg’s clandestine maneuvers have raised eyebrows not only within tech circles but also among cryptocurrency investors. As one of the leading figures in the digital landscape, Zuckerberg’s influence could stir significant repercussions in the already volatile cryptocurrency market. If the rumored plans materialize, we could witness a ripple effect that transforms trading behaviors, investor sentiment, and even regulatory scrutiny. Experts suggest that targeting the Bitcoin price could potentially introduce new dynamics such as:

Moreover, the aftermath of such a scenario could be analyzed through various platforms and exchanges, leading to a diversified landscape for traders and investors alike. A shift led by an influential figure might catalyze new layers of market interactions, prompting both retail and institutional players to reassess their strategies. The table below highlights potential outcomes and their likelihood based on current market analysis:

| Potential Outcome | Likelihood (High/Medium/Low) | Impact Description |

|---|---|---|

| Massive Increase in Bitcoin Adoption | Medium | Increased interest may drive mainstream adoption among businesses. |

| Market Correction Following Speculation | High | Post-hype corrections may lead to sharp sell-offs. |

| Emergence of New Crypto projects | Low | New noteworthy projects could rise as a result of increased funding. |

As the cryptocurrency market continues to evolve, investors must cultivate strategies that not only withstand market volatility but also capitalize on emerging opportunities. In this shifting landscape, it’s vital for investors to stay informed about influential players and their potential impact on market dynamics. Some effective tactics include:

Moreover, analyzing market trends and investor sentiment can provide insights into potential shifts.Building a network of trusted sources and engaging in community discussions can yield valuable data.Consider the following factors when formulating your investment strategy:

| Factor | Impact on Market |

|---|---|

| Influential Figures | Potential price fluctuations based on their actions or statements. |

| Market regulation | New laws can create or limit market opportunities. |

| Technological Innovations | Improvements can lead to increased confidence and investment. |

the unfolding narrative surrounding Mark Zuckerberg and his purported plans to influence the Bitcoin price and the broader crypto market opens the door to a wealth of speculation and intrigue. Whether these leaks hold any truth or simply serve as a reflection of our current fintech anxieties, the implications for investors, technologists, and regulators alike are profound. As the digital currency landscape continues to evolve, its intersection with powerful figures and tech giants raises essential questions about market integrity, innovation, and the future of decentralized finance. As we watch this story develop, it becomes increasingly clear that, in the world of crypto, nothing is ever truly off the table.Stay vigilant, stay informed, and follow the flux of the market—the next chapter may be just around the corner.