In the ever-evolving landscape of home improvement, the desire for personalized living spaces has sparked a surge in renovation projects across the country.Recognizing this growing trend, Hanley Economic Bank is stepping into the spotlight with an innovative solution designed to empower homeowners and transform their visions into reality. With the launch of their new home renovation loan, the bank aims to provide a financial pathway for those looking to upgrade, enhance, or even rebuild their sanctuary. This article delves into the specifics of this fresh offering, exploring how it can open doors for homeowners ready to revitalize their spaces and create the perfect environment tailored to their needs.

Home Renovation Loans Unveiled by Hanley Economic BS

Hanley Economic BS has introduced an exciting opportunity for homeowners looking to enhance their living spaces with their latest offering: a range of home renovation loans. Designed to cater to diverse financial needs, these loans come with attractive features aimed at simplifying the renovation process. With flexible repayment options and competitive interest rates, homeowners can now transform their houses into dream homes without the financial burden often associated with large-scale renovations. Key benefits include:

- Rapid approval process: Get the funds you need in a timely manner.

- Personalized loan amounts: Borrow based on your specific renovation needs.

- No hidden fees: Transparent terms that help you avoid surprises.

This initiative supports various renovation projects, whether you’re looking to modernize your kitchen, enhance energy efficiency, or create an outdoor oasis. Hanley Economic BS is committed to making home improvement accessible, ensuring that homeowners can make meaningful changes to their residences with ease.Below is a table summarizing the essential features of the loan:

| Loan Feature | Details |

|---|---|

| Loan Amount | Up to $50,000 |

| Interest Rate | Starting at 3.5% |

| Repayment period | 5 to 20 years |

Key Benefits of the New Home Renovation Financing Options

With the launch of tailored home renovation financing options by Hanley Economic Bank, homeowners can now embark on their renovation journeys with greater ease and confidence. These financing solutions come with flexible repayment plans, allowing for monthly payments to fit various budgets and financial situations. Additionally, the low-interest rates offered can significantly reduce the overall cost of renovation, making dreams of home improvement more accessible than ever. By providing personalized financing packages, Hanley Economic Bank empowers homeowners to choose the best path for their specific project needs.

Furthermore, the streamlined submission process ensures that obtaining financing is hassle-free and efficient. Homeowners can expect quick approvals, allowing them to initiate renovations without needless delays. The option to combine multiple renovations into one loan simplifies financial management, letting homeowners focus on transforming their spaces rather than juggling multiple funding sources. Below is a comparison of key features that make these financing options standout:

| Feature | Standard Financing | Hanley Economic Financing |

|---|---|---|

| Interest Rates | Higher | Lower |

| Repayment Versatility | Fixed | Customizable |

| Application Speed | Slow | Quick |

| Combination of Projects | No | Yes |

Understanding the Application Process for Renovation Loans

embarking on the journey to finance your home renovation can undoubtedly feel overwhelming,but understanding the steps involved can simplify the process significantly. When applying for a renovation loan through Hanley Economic BS, prospective borrowers should start by gathering essential documentation, such as proof of income, credit history, and details about the proposed renovation project. This documentation is crucial, as lenders assess your financial stability and the potential value that the renovations will add to your home.

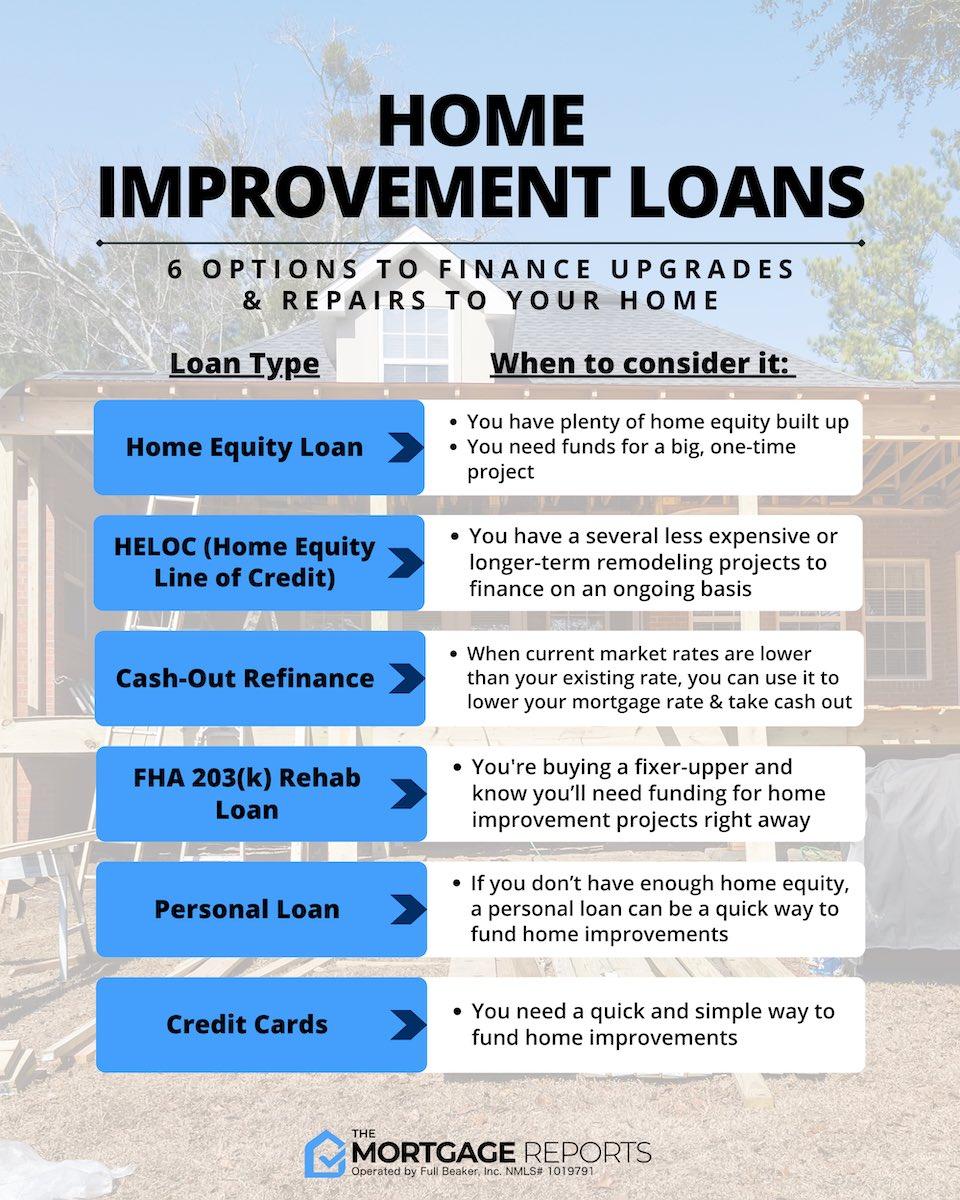

Once your documents are in order, it’s advisable to consult with a loan officer who can guide you through the specifics of the loan products available. Each type of renovation loan may have unique criteria and benefits, so you should consider the factors below when discussing options:

- loan Amount: Determine how much you need based on the scope of your renovation.

- Interest Rates: Variances in rates can affect your monthly payments significantly.

- Repayment Terms: evaluate the flexibility of payment schedules that suit your financial situation.

- Eligible Projects: Clarify which types of renovations are covered under the loan.

- Timeframe: Understand the timeline for application processing and fund disbursement.

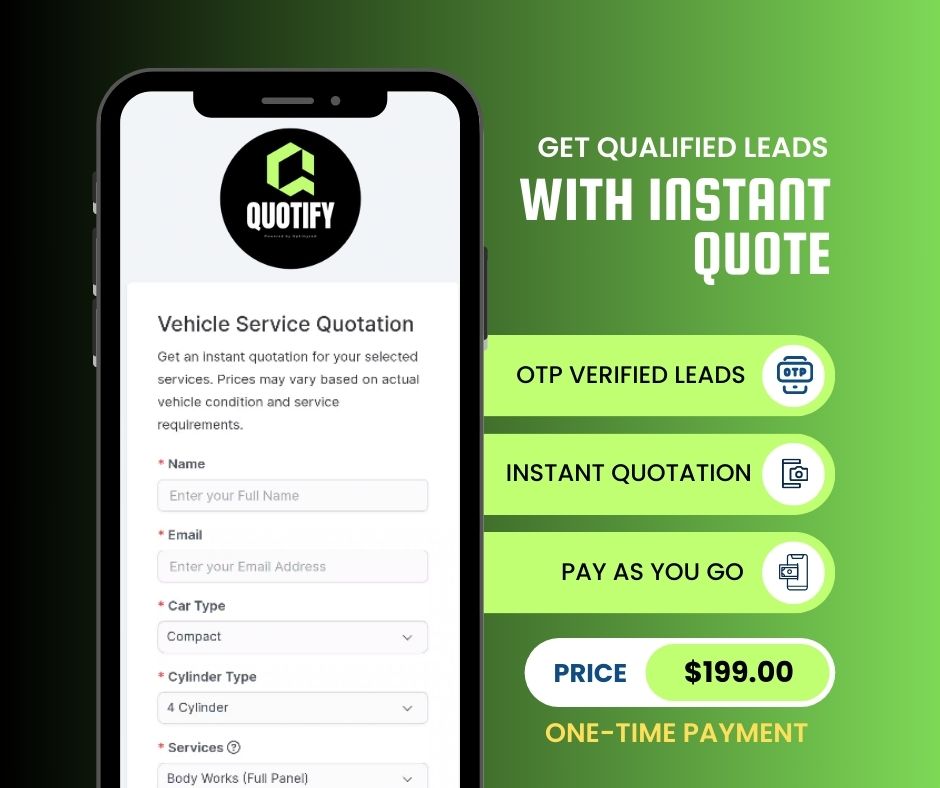

| Loan Type | Interest Rates | Repayment Period |

|---|---|---|

| Home Equity loan | 3.5% – 5.5% | 5 - 15 years |

| FHA 203(k) | 3.0% – 6.0% | 15 – 30 years |

| Personal Loan | 6.0% – 20.0% | 2 – 7 years |

Expert Tips for Maximizing Your Home renovation Investment

To ensure that your home renovation yields the highest return on investment,it’s essential to have a strategic approach. Start by setting a clear budget that encompasses both expected expenses and a contingency fund for unforeseen costs. Prioritize renovations that enhance curb appeal, such as upgrading your front door or landscaping, as these improvements can significantly boost your home’s attractiveness. Focus on high-traffic areas like the kitchen and bathrooms—updating fixtures or cabinetry can transform these spaces without a complete overhaul. Remember to research the current real estate market trends in your neighborhood, as certain renovations may offer a greater return depending on your location.

Investing in quality materials and skilled labor can also make a substantial difference in the longevity and appeal of your renovations. Consider the following tips:

- Choose Energy-Efficient Upgrades: Items like double-pane windows or smart thermostats appeal to eco-conscious buyers.

- Maintain Consistency: Ensure that your home retains a cohesive style throughout, which can enhance its overall appeal.

- Stay Ahead of Trends: Research popular design trends but also consider timeless designs to avoid quick obsolescence.

Lastly, determine if you can do any DIY projects. Simple tasks, such as painting or landscaping, can add significant value when done correctly, allowing you to allocate saved funds to more complex renovations. Keep track of all your expenses and photo-document the process to help in discussions with future buyers.

The Way Forward

the launch of the home renovation loan by Hanley Economic Bank marks a significant step in empowering homeowners to reimagine their living spaces without the burden of financial stress. This innovative offering not only enhances accessibility to funds but also encourages creativity and personal expression in home design. As homeowners take advantage of this new opportunity, they can look forward to transforming their residences into havens that reflect their unique tastes and lifestyles. Whether it’s a modest update or a grand redesign, Hanley Economic Bank’s commitment to supporting home improvement projects is paving the way for a revitalized housing landscape. With this initiative, the possibilities for creating your dream home are just a loan away.