In an era where digital landscapes continuously reshape the way we connect and consume, a striking trend has emerged in the UK advertising domain: nearly half of all advertising spend last year flowed into the coffers of two tech giants—Google and meta. As brands increasingly pivot towards online platforms to capture audience attention, this ample concentration of investment raises critical questions about the future of marketing, the influence of these behemoths on the advertising ecosystem, and what it means for smaller players striving for visibility in a saturated marketplace. This article delves into the implications of this trend, exploring how the dominance of these platforms is reshaping the advertising paradigm, and what it signals for marketers and consumers alike in an increasingly digital world.

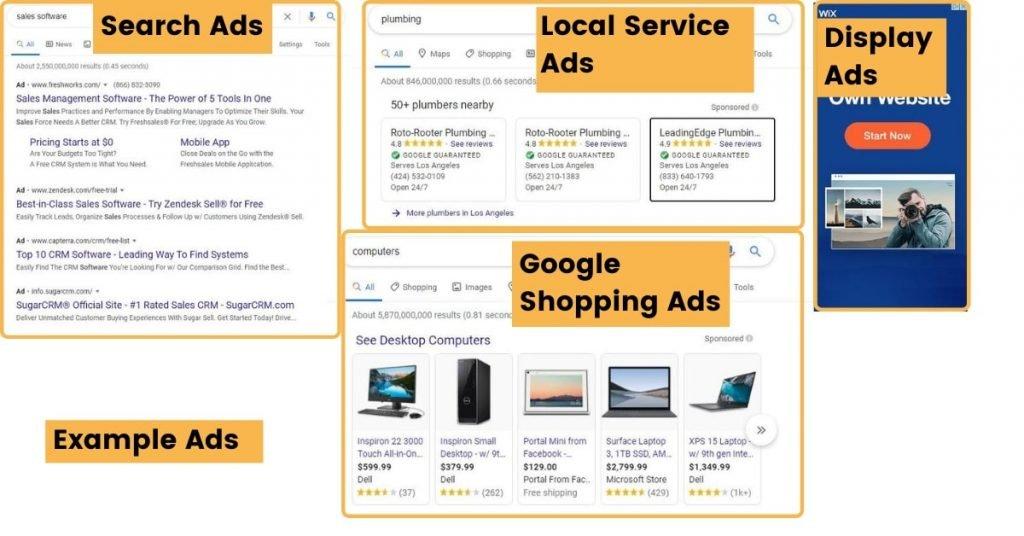

The rise of Google and Meta has reshaped the advertising landscape in the UK, wiht both tech giants capturing the lion’s share of digital ad spending. As marketers pivot their strategies towards digital channels, these platforms have provided targeted solutions that appeal to businesses of all sizes. Their dominance can be attributed to several key factors:

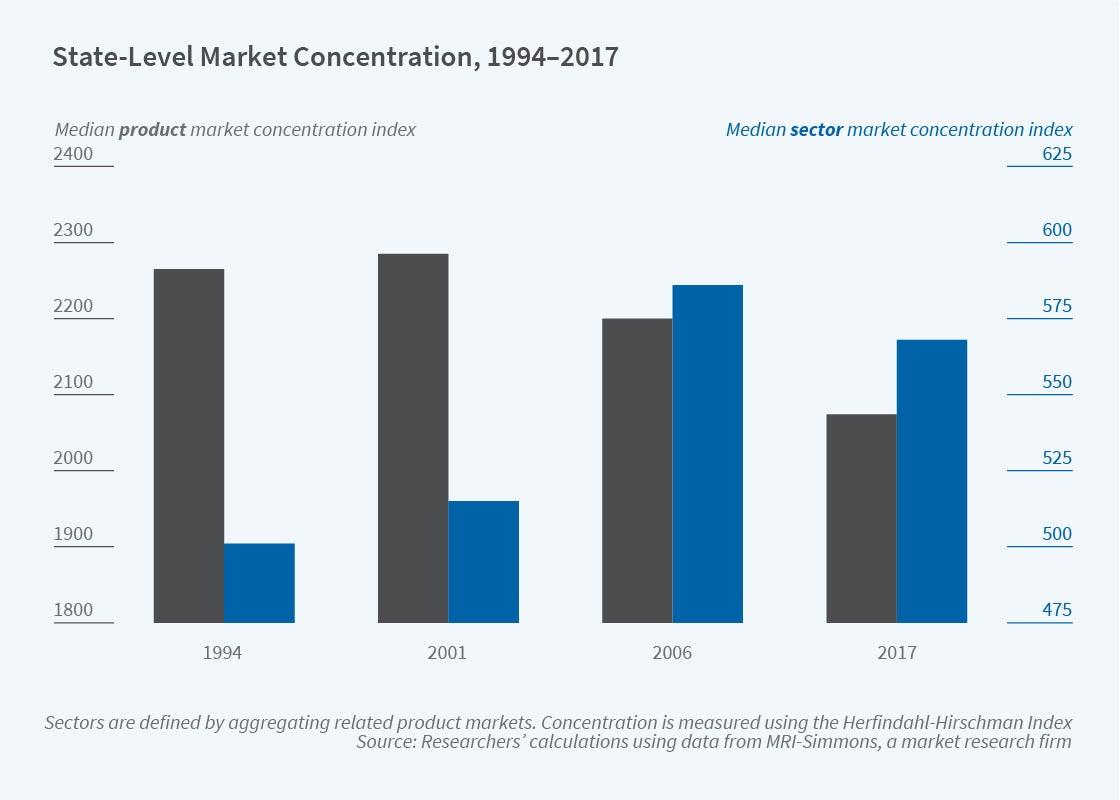

This concentration of spending underscores a notable shift in how brands are connecting with consumers. To illustrate the extent of their influence,consider the distribution of advertising spend across platforms in the UK:

| Platform | Market Share (%) |

|---|---|

| 40 | |

| Meta (Facebook & Instagram) | 30 |

| Other Platforms | 30 |

This table highlights how the combined efforts of Google and Meta not only dominate the digital advertising market but also reflect a broader trend in consumer engagement,forcing other platforms to innovate rapidly in order to compete. As businesses adapt to this new reality, the implications of such market control raise questions about the future landscape of advertising and the balance of power within the industry.

Market concentration has a profound effect on how businesses approach advertising strategies. With Google and Meta commanding nearly 50% of the UK advertising spend, companies must navigate a landscape increasingly dominated by a few major players. This concentration drives brands to rethink their tactics, emphasizing the need for targeted advertising that leverages the complex algorithms these platforms offer. In this environment,advertisers find themselves compelled to create content that not only captures attention but also effectively engages users who are inundated with a constant stream of ads. As an inevitable result, the focus shifts to enhancing brand storytelling and building more meaningful connections with consumers.

In exploring various advertising methods within a concentrated market, organizations increasingly turn to data analytics to assess performance metrics. Key performance indicators (KPIs) help gauge the success of strategies that rely heavily on the dominant platforms. Consider the following metrics that advertisers now prioritize:

to illustrate the shifting landscape of advertising expenditures, the following table summarizes the share of UK ad spends among major platforms:

| Platform | Ad Spend Share (%) |

|---|---|

| 30 | |

| Meta (Facebook & Instagram) | 20 |

| Other Digital | 25 |

| Traditional Media | 25 |

This data highlights the unusual influence of a select few platforms on advertising strategies, encouraging businesses to innovate and adapt to an evolving digital ecosystem that prioritizes efficiency and consumer connection.

As the digital landscape evolves, brands are increasingly seeking option platforms to diversify their advertising strategies beyond the dominance of Google and Meta. Several innovative options are emerging, each offering unique advantages that can help brands connect with diverse audiences. Consider these alternatives:

To further illustrate the opportunities available,the table below highlights innovative platforms along with key characteristics that set them apart:

| Platform | Key Feature | Ideal For |

|---|---|---|

| Snapchat | Augmented Reality Filters | Brand Engagement with Youth |

| TikTok | Short-Form Video Content | Creative Storytelling |

| Visual Search Technology | Product Discovery and Shopping | |

| Programmatic Platforms | Data-driven Ad Placement | High ROI Campaigns |

As brands navigate the digital advertising landscape dominated by giants like google and Meta, establishing a balanced approach to digital spend is essential. diversifying advertising platforms can minimize risk and enhance brand visibility. Consider investing in a variety of channels, such as:

Moreover, brands should utilize data analytics to assess the performance of their spending across various platforms continuously.This approach can reveal insights into which formats yield the best ROI.To facilitate this, consider creating a performance tracking table like the one below:

| Platform | Monthly Spend | Conversion Rate | Comments |

|---|---|---|---|

| Google Ads | £10,000 | 3.5% | Strong traffic; focus on long-tail keywords. |

| Meta Ads | £8,000 | 2.8% | Check audience targeting; test new creatives. |

| YouTube Ads | £5,000 | 4.1% | High engagement; consider longer video formats. |

| Emerging Platform | £2,000 | 1.5% | experiment with content style; monitor closely. |

As we navigate the ever-evolving landscape of digital advertising, the dominance of Google and Meta continues to reshape the UK’s marketing terrain. With half of the nation’s advertising expenditure funneled towards these tech giants, it raises pivotal questions about the future of creativity, competition, and consumer choice in the industry. While their extensive reach offers unparalleled opportunities for brands to connect with audiences, it also underscores the need for a balanced marketplace that fosters innovation beyond the duopoly. As advertisers and regulators alike grapple with this reality, one thing remains clear: the digital stage is set, and its players are redefined. The journey ahead will undoubtedly be shaped by these shifts, sparking a conversation that is both necessary and timely.As we close this chapter, we invite you to ponder the implications of this trend and consider what lies beyond the horizon for advertising in the UK.