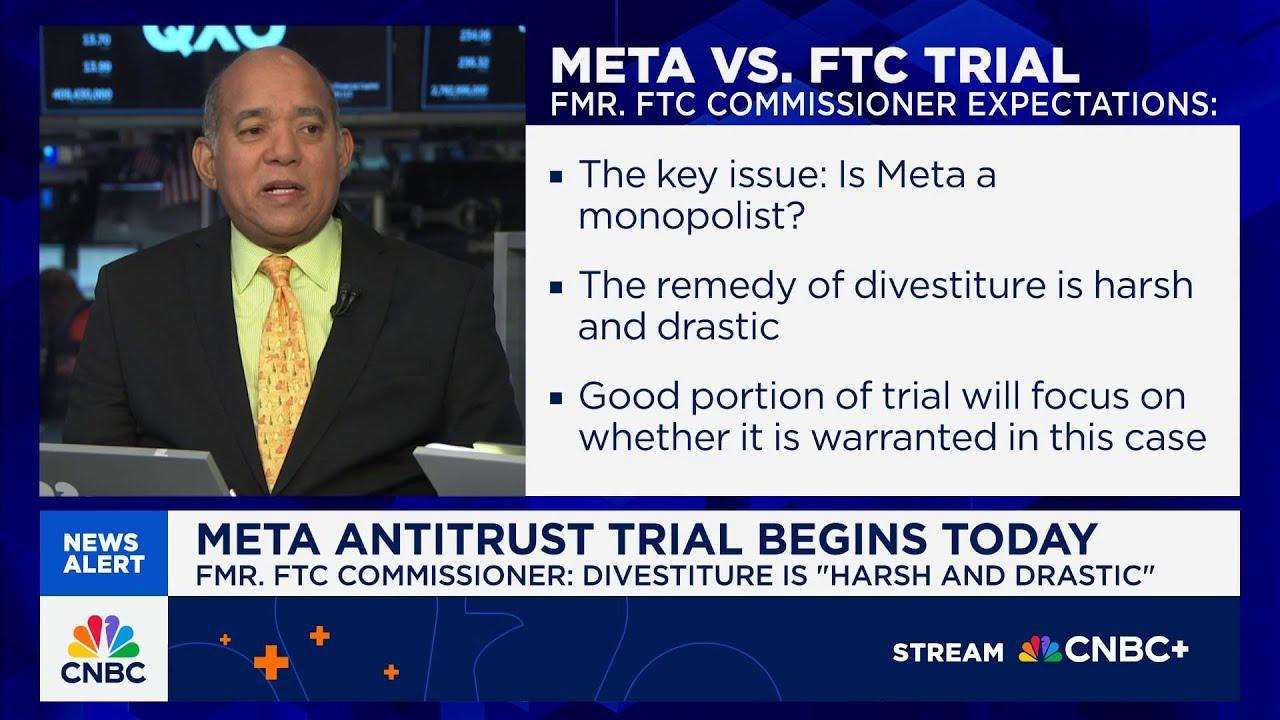

In the ever-evolving landscape of social media, the potential for seismic shifts looms large as regulatory scrutiny intensifies around major platforms. As discussions swirl regarding the future of Meta’s sprawling empire, a pivotal question emerges: if the tech giant is compelled to divest its crown jewels—Instagram, WhatsApp, or Facebook—what would be the public’s choice? In a revealing new survey, 43% of respondents cast their vote for one standout, underscoring not only individual preferences but also broader trends in the way users interact with digital interaction and social sharing. In this article,we delve into the implications of such a potential divestiture and explore the reasons behind the public’s favored choice in this high-stakes scenario.

The prospect of Meta divesting from its flagship platforms—Instagram, WhatsApp, or Facebook—carries notable implications for the company and the broader digital landscape. Analysts suggest that such a move could catalyze a conversion in user engagement strategies, competition, and market dynamics. As a notable example:

Moreover,the corporate structure could shift dramatically depending on which platform is divested. An analysis reveals potential outcomes of such a scenario:

| Platform | Potential Impact |

|---|---|

| Rise of visual-centric platforms,increased competition in influencer marketing. | |

| Boost for messaging apps, enhanced focus on privacy and security features. | |

| Shifts in social networking dynamics, potential resurgence of niche platforms. |

The findings of recent surveys have revealed a striking preference among users when faced with a scenario where Meta might be compelled to sell one of its platforms. A notable 43% of respondents indicated a strong inclination towards retaining Instagram over other options like WhatsApp and Facebook. This preference highlights Instagram’s unique ability to blend community engagement with visual storytelling, thereby creating an irreplaceable space for both personal expression and brand discovery. Users appreciate the platform’s intuitive interface and the variety of features, including Stories, Reels, and direct messaging, which foster a more dynamic and interactive social experience.

Several factors contribute to the standout position of Instagram in consumer preferences. Among these, the following elements are particularly significant:

| Platform | User Preference (%) |

|---|---|

| 43 | |

| 28 | |

| 29 |

In a landscape where divestitures are becoming an increasingly likely scenario for major tech companies,the strategic value of WhatsApp emerges as a critical point of discussion. With its vast user base and unmatched encryption features, the messaging platform not only facilitates personal communication but also plays a pivotal role in business operations.The ability of WhatsApp to connect businesses directly with consumers through features like WhatsApp Business empowers brands to enhance customer engagement and streamline operations.This practicality makes WhatsApp an indispensable asset in a divestiture scenario, offering both financial returns and competitive advantages.

Furthermore, WhatsApp’s integration with other platforms and its rich array of functionalities enhance its strategic position.As companies consider which assets to retain or divest, the multipurpose capabilities of WhatsApp—including voice calls, video conferencing, and multimedia sharing—create a significant value proposition. Key aspects of WhatsApp’s strategic importance include:

| Feature | |||

|---|---|---|---|

| User Base | 2 billion+ | 1.4 billion+ | 2.9 billion+ |

| Main Functionality | Messaging | Photo sharing | Social networking |

| business Features | Comprehensive | Limited | Robust |

Considering impending regulatory scrutiny, it is imperative for Meta to adopt a proactive approach to mitigate risks associated with potential divestitures. Emphasizing transparency in communications and actively engaging with regulators will be essential. key recommendations for Meta include:

Additionally, diversifying the core business model could provide a safety net against market fluctuations and regulatory pressures. By exploring new avenues for growth, Meta can build resilience and maintain its competitive edge. Some strategies to consider are:

| Strategy | Description |

|---|---|

| Content Monetization | Explore new advertising models and subscription services to diversify revenue. |

| Collaborative Ventures | Partner with other firms for innovative experience and technologies, enhancing user engagement. |

| AI and machine Learning | Invest in AI to improve user experience and streamline operations, keeping Meta ahead of the curve. |

the prospect of Meta potentially divesting one of its flagship platforms has ignited a complex conversation about digital ecosystems and consumer choice. As preferences shift and the realities of a changing regulatory landscape become clearer, the insights derived from our exclusive survey reveal notable sentiments among users.with 43% of respondents favoring one standout platform over the rest, this data offers a compelling glimpse into the minds of the social media landscape’s moast engaged users. While the future remains uncertain, the implications of such a pivot for both Meta and its user base could be profound. As we continue to explore the dynamics of social media and the influence of corporate structures, one thing is clear: the conversation has only just begun. Stay tuned as we follow this evolving story and its potential reverberations across the digital world.