In an era where technological advancements often dictate the pulse of the global economy, Big Tech continues to navigate a landscape fraught with challenges and uncertainties. Recent earnings reports from industry giants Microsoft and Meta have emerged as a beacon of optimism for investors, defying prevailing market anxieties. With both companies surpassing forecasts, their performance not only provides a glimpse into their strategic resilience but also serves to reassure stakeholders amid a backdrop of volatility. As we explore the factors contributing to this upbeat sentiment, we delve into the implications of these financial results and what they signify for the broader tech ecosystem and beyond.

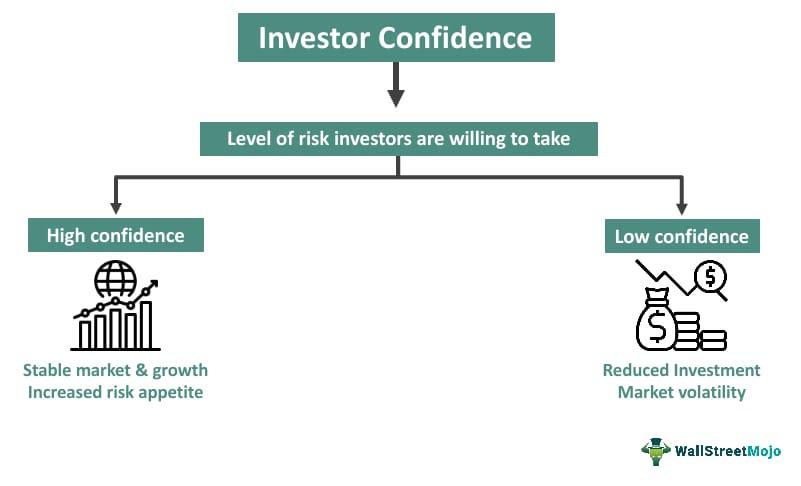

In a landscape where investor confidence has been shaky, Microsoft and Meta have emerged as beacons of stability, demonstrating their remarkable resilience in earnings. Both companies not only met but exceeded market expectations, showcasing their robust business models and strategic pivots in response to evolving consumer behavior. This adaptability has allowed them to capitalize on trends such as cloud computing, artificial intelligence, and social media monetization, ensuring impressive growth amidst economic uncertainty. For Microsoft,a focus on cloud services and enterprise solutions played a pivotal role,while Meta’s innovations in social commerce and augmented reality have opened new revenue streams.

Key highlights from their earnings reports illustrate the strength behind their performance:

| Company | Earnings Per Share (EPS) | Revenue Growth (%) |

|---|---|---|

| Microsoft | $2.69 | 15 |

| Meta | $3.18 | 12 |

The recent earnings reports from tech giants like Microsoft and Meta have sent ripples through the investment community, effectively calming the jittery nerves of investors who had been on edge due to earlier economic turbulence. By not only meeting but exceeding expectations, these companies have showcased resilience amid market volatility. Key performance indicators that contributed to this restored confidence include:

Market response has been overwhelmingly positive, reflected in the surge in share prices of both companies shortly after their announcements. Investors are speculating whether this trend will continue, with analysts highlighting multiple factors that could dictate the market’s trajectory moving forward:

| Factor | Impact on Market |

|---|---|

| Interest Rates | Higher rates could temper growth expectations. |

| Economic Indicators | Inflation and employment data will guide investor sentiment. |

| Technological Advancements | Innovation could drive future profitability. |

With Wall Street placing renewed faith in big tech, the broader indices have received a boost, setting the stage for potential gains in other sectors as well. As investors keep a close watch on geopolitical developments and domestic fiscal policies, the sentiment towards tech stocks will likely serve as a bellwether for market stability in the months ahead.

In the ever-evolving landscape of technology,Microsoft and Meta have demonstrated impressive resilience and adaptability. By implementing strategic innovations, these giants have been able to outpace market expectations and ease investor uncertainties. Key initiatives included:

Furthermore, collaboration played a significant role in their strategies. Microsoft secured strategic partnerships with numerous tech startups, fostering innovation through shared resources. Meanwhile, Meta focused on building robust relationships with creators, ensuring a vibrant ecosystem that attracts users to its platforms. The following table highlights some of the key strategic moves:

| Company | Key Strategy | Expected impact |

|---|---|---|

| Microsoft | Enhanced AI Tools | Increased user engagement and productivity |

| Meta | Metaverse Development | Attraction of new users and retention of existing ones |

| Both | Partnership Expansion | Accelerated innovation and market presence |

The recent earnings reports from tech giants like Microsoft and Meta have not only surpassed expectations but have also provided valuable insights into emerging investment strategies. As the tech landscape continues to evolve at a rapid pace, investors must adapt to the shifting dynamics by focusing on sectors that exhibit resilience and potential for growth. With advancements in artificial intelligence,cloud computing,and digital advertising,savvy investors should consider diversifying their portfolios to capitalize on these transformative trends. Key strategies might include:

To streamline decision-making,investors should also leverage financial metrics and analyst forecasts. A comparative overview of key players in the tech market can definitely help identify which companies are positioned for future success. The table below outlines essential statistics for Microsoft and Meta following their recent earnings calls:

| Company | Earnings Per Share | Year-Over-Year Growth | Market Capitalization |

|---|---|---|---|

| Microsoft | $2.69 | 15% | $2.45 Trillion |

| Meta | $3.15 | 24% | $893 Billion |

Such metrics not only highlight the current health of these companies but also serve as indicators of their potential to weather market fluctuations. By aligning investment strategies with companies that demonstrate solid performance and future growth prospects, investors can effectively navigate the complexities of the tech landscape.

As we reflect on the latest financial revelations from Microsoft and Meta, it becomes clear that the landscape of Big Tech continues to evolve, revealing both resilience and innovation amid global uncertainty. Their better-than-expected earnings not only quench the thirst of anxious investors but also suggest a potential shift in prevailing market sentiments. While technology giants face ongoing challenges—from regulatory scrutiny to ever-changing consumer behaviors—their ability to surpass forecasts highlights the critical role they play in driving economic momentum. As we move forward, it will be interesting to observe how these companies navigate the complex interplay of competition, adaptation, and growth. The future remains unwritten, but for now, the buoyancy in Big Tech provides a glimmer of optimism—a beacon for stakeholders as they chart their course in this dynamic sphere.