In the ever-evolving landscape of technology and business, the tides can shift dramatically within a single quarter. As we dive into the latest updates, we examine Alphabet’s recent financial performance that surprised analysts with a robust Q1 beat, contrasting sharply with the challenges faced by Meta as it grapples with widespread layoffs within its Reality Labs division.Meanwhile, Intel’s outlook paints a cautious picture, hinting at ongoing struggles in a competitive market. This article delves into the implications of these developments, exploring how they shape the current tech ecosystem and what they may signal for the future of innovation and employment within these major players.

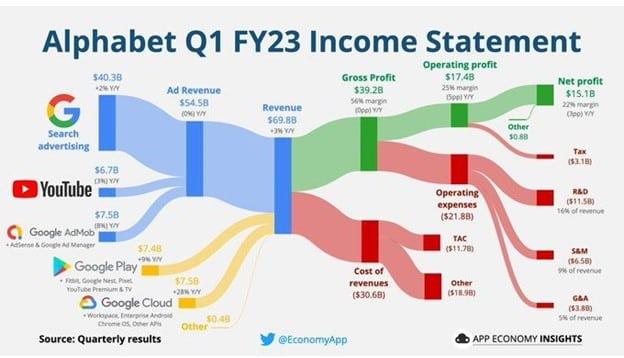

Alphabet’s remarkable Q1 performance can largely be attributed to several key drivers that have propelled its growth trajectory. Frist and foremost,advertising revenue continues to remain a cornerstone of Alphabet’s success. With a renewed focus on personalized ad experiences and innovative solutions leveraging AI, the company has successfully tapped into emerging digital ad markets. Additionally, an increasing demand for cloud services has fueled the expansion of Google Cloud, allowing them to capture market share from competitors, wich has significantly enhanced overall revenue.

Moreover, Alphabet’s investments in diversification have begun to pay off, as ventures in hardware and subscription services show promising results. The launch of products like the Pixel smartphone and integrations with Google Workspace have attracted a loyal customer base, contributing to a well-rounded revenue stream. Furthermore,the company’s commitment to sustainability initiatives has created a favorable image,bolstering brand loyalty among environmentally conscious consumers. As a result, Alphabet’s market strategy is not only financially advantageous but also positions the company as a leader in responsible corporate practices.

As Meta undergoes a significant restructuring within its Reality Labs division, the ramifications of workforce reductions are starkly evident. The decision to lay off a considerable number of employees has sparked conversations about the future of the company’s enterprising metaverse initiatives.the effects of these layoffs are multifaceted, impacting not only the displaced workers but also the overall innovation ecosystem. Key points to consider include:

The restructuring raises questions about the company’s long-term viability in a rapidly evolving tech landscape. By slicing through its workforce, Meta aims to streamline projects; however, the loss of talent can lead to a gap in creativity and diverse skill sets essential for innovative breakthroughs. A preliminary analysis of the impacts is demonstrated in the table below:

| Impact Area | Current Status | Predicted Future Effect |

|---|---|---|

| Project Development Speed | Decelerating | Further Delays |

| Employee confidence | waning | Increased Turnover Risk |

| Innovation Capacity | Limited | Potential Stagnation |

Intel’s latest forecast has sent ripples of concern through the tech world, signaling a turbulent period ahead for the semiconductor giant. With decreasing demand for PCs and the ongoing supply chain disruptions, Intel faces formidable challenges that could reshape its market positioning. Analysts have noted several key factors contributing to this precarious outlook:

In light of these challenges, Intel is reevaluating its strategic initiatives to regain footing. This includes a focus on diversifying its product line to address the needs of emerging markets such as AI and data centers. The company has outlined plans to invest in new technologies while ensuring operational efficiencies. As they navigate this turbulent landscape, Intel’s adaptability may ultimately determine its resilience in a highly competitive environment. The upcoming quarters will be critical as investors watch closely for signals of recovery or further decline.

As industry dynamics continue to evolve, stakeholders must remain agile, adapting their strategies to navigate the complexities presented by recent developments. The optimistic performance of alphabet in Q1 indicates an possibility for investment in digital advertising technologies, with a focus on analytics and performance measurement tools gaining increased importance. Companies should consider:

In contrast, Meta’s recent layoffs in its Reality Labs division reveal the need for strategic recalibration in response to market sentiment surrounding augmented and virtual reality. Stakeholders must prioritize innovation while ensuring cost efficiency. Considerations should include:

| Company | Recent Action | Strategic Focus |

|---|---|---|

| Alphabet | Q1 Earnings Beat | Invest in Digital Advertising Tech |

| Meta | Reality labs Layoffs | refine Existing Platforms |

| Intel | Weak Future Outlook | R&D in Chip Technology |

As we close the curtain on this quarter’s tech theater, three prominent players take their bows, each revealing a different act in the unfolding drama of the digital age. Alphabet’s performance showcases resilience amid challenges, confidently reminding us of the rewards of adaptability.In stark contrast, Meta’s Reality Labs cuts signal a strategic retreat from ambitious aspirations, prompting us to ponder the price of innovation in a rapidly shifting landscape. Meanwhile, Intel’s cautious outlook underscores the complexities of the semiconductor saga, where expectations must be tempered with realism.As investors and tech enthusiasts alike reflect on these narratives, one thing becomes clear: the tech sector remains a multifaceted play, filled with unexpected twists and turns. The ongoing saga continues next quarter, and as we watch these industry giants navigate their paths, we are reminded that every performance, whether a triumph or a setback, contributes to the larger story of progress and reinvention in the digital realm. Until next time, stay informed and engaged, as the journey through the world of technology unfolds.