In a rapidly evolving technological landscape, few companies have demonstrated the resilience and adaptability necessary too weather market fluctuations quite like Amazon and Meta. as industry giants in e-commerce and social media, respectively, both firms have cultivated robust strategies that not only allow them to navigate challenges but frequently enough position them ahead of the curve. Recent insights from seasoned investors underscore this sentiment,highlighting how these titans are uniquely equipped to tackle the complexities of the modern market.In this article, we delve into the key factors that enable Amazon and Meta to thrive amidst uncertainty, exploring their innovative approaches, strategic pivots, and the underlying strengths that have garnered investor confidence in these powerhouse companies.

In a world where market volatility seems inevitable, some companies rise above the fray, demonstrating remarkable adaptability and strength. Amazon and Meta exemplify this resilience, buoyed by diverse revenue streams, robust operational frameworks, and innovative strategies. Their ability to pivot swiftly in response to shifting market conditions allows them to maintain a competitive edge, ensuring sustainable growth even when external circumstances turn turbulent. The sheer scale of these organizations not only provides them with a safety net but also enables them to invest in emerging opportunities that arise in challenging times.

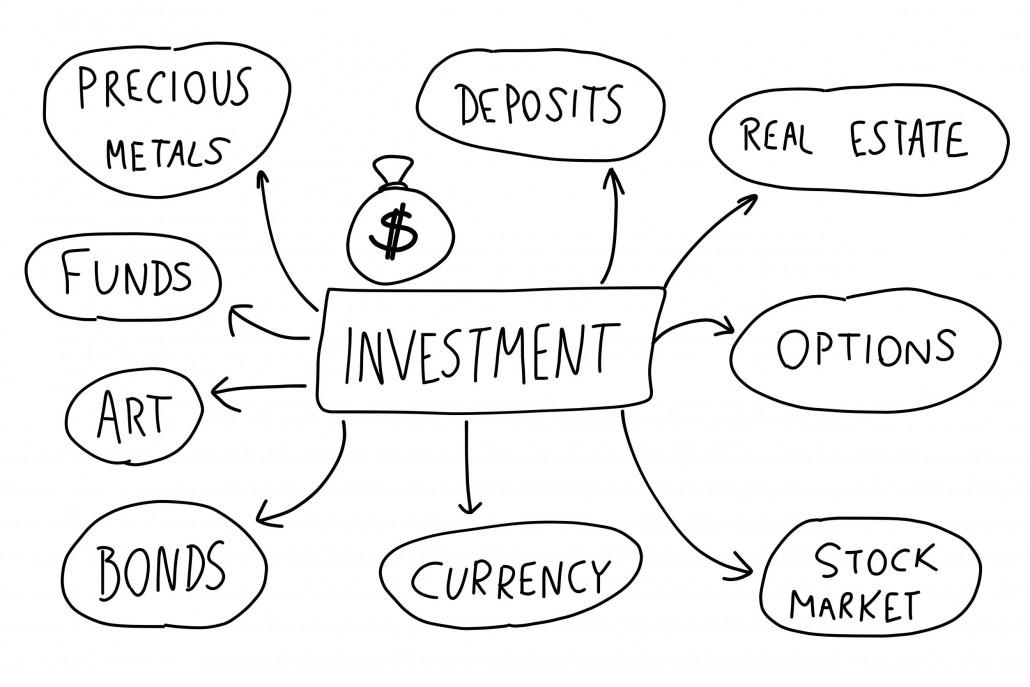

Investors frequently enough look for indicators of resilience in a company’s structure and market approach. Factors influencing this resilience include:

A recent analysis of their financial performance showcases their ability to maintain profitability amidst economic challenges:

| Company | Q2 Revenue (2023) | Market Growth Rate (%) |

|---|---|---|

| Amazon | $134 Billion | 9.5% |

| Meta | $32 Billion | 7.1% |

as global economies navigate the complexities of technological advancement and shifting consumer behaviors, companies like Amazon and Meta have demonstrated agility and resilience, making them well-positioned to manage market challenges. Their success can be attributed to several key strategies that allow them to thrive amidst change:

Additionally, these companies focus on building robust relationships with stakeholders, fostering loyalty and trust that translates into lasting customer engagement. Here’s a simplified comparison illustrating how Amazon and meta approach growth differently yet effectively:

| Company | Growth Strategy | Focus Area |

|---|---|---|

| Amazon | Market Adaptation | Consumer Goods & Services |

| Meta | Technological Integration | Social Connectivity & Advertising |

As the landscape of business continues to evolve, companies like Amazon and Meta are at the forefront of leveraging cutting-edge technologies to address various market challenges. Their ability to integrate advanced analytics, artificial intelligence, and machine learning into their operations allows them to anticipate consumer trends, optimize supply chains, and improve customer engagement. This proactive approach not only mitigates risks but also positions these giants to capitalize on opportunities that may arise amidst uncertainty.

To illustrate the impact of technological innovation on their market agility, consider the following key strategies employed by these firms:

These strategies contribute to a robust business infrastructure, enabling them to respond quickly and effectively to changing market conditions. The investment in technology not only fortifies their market position but also sets a standard for adaptability that other companies aspire to achieve.

In today’s volatile financial landscape, the resilience of technology giants such as Amazon and Meta presents intriguing investment prospects. As traditional metrics become increasingly unreliable during periods of uncertainty, these companies have demonstrated an ability to swiftly adapt their strategies in response to dynamic market conditions. Their robust infrastructures and diversified business models allow them to absorb shocks and capitalize on emerging trends, thereby providing a layer of security that many investors find appealing.

when considering potential investments, it is essential to focus on companies that have fortified themselves against unpredictable market trends. Some key attributes to look for include:

For ease of comparison, we can summarize the attributes of Amazon and Meta in the table below:

| company | Market Adaptability | Diversity of Revenue | Investment in Innovation |

|---|---|---|---|

| Amazon | High | Retail, Cloud Computing, Streaming | Significant |

| Meta | Moderate | Social Media, Virtual Reality, Advertising | Robust |

while the financial landscape may be fraught with uncertainties and evolving market conditions, industry giants like Amazon and Meta have demonstrated a remarkable resilience and adaptability that sets them apart. Investors keenly recognize these attributes,suggesting that both companies possess the infrastructural strength and innovative acumen to navigate challenges with a strategic foresight that many of their competitors may lack. As we look toward the future, it will be intriguing to watch how these titans continue to leverage their unique positions and capabilities. For investors, the journey ahead may hold both risks and opportunities—but with Amazon and Meta at the helm, the path seems a little less daunting.