As the financial quarter draws to a close, the air is thick wiht anticipation as investors and analysts alike prepare for one of the defining moments of the earnings season: the weekly reports from major players in the tech industry. This week, all eyes turn to Apple and Meta, two titans whose performances have the power to sway market sentiment and set the tone for the months ahead. With groundbreaking innovations, shifting consumer behaviors, and an ever-evolving digital landscape at the forefront, the earnings playbook for these companies offers not just a glimpse into their financial health, but also insights into the broader narratives that shape our technological future.In this article, we delve into what to expect from this pivotal week, unpacking the metrics, trends, and implications that could resonate far beyond the stock market.

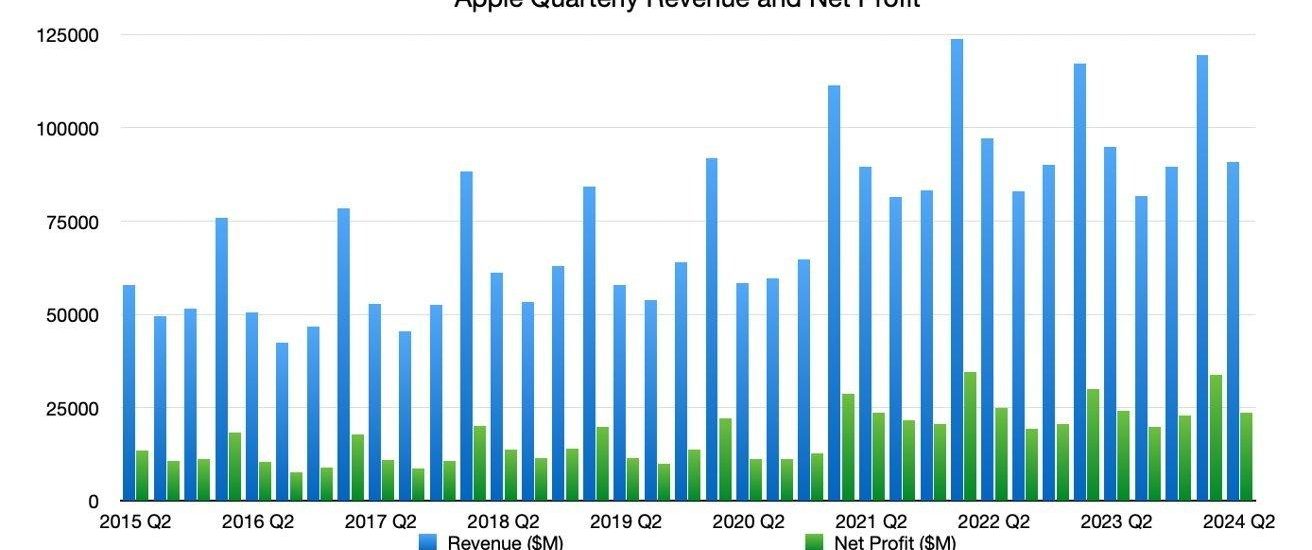

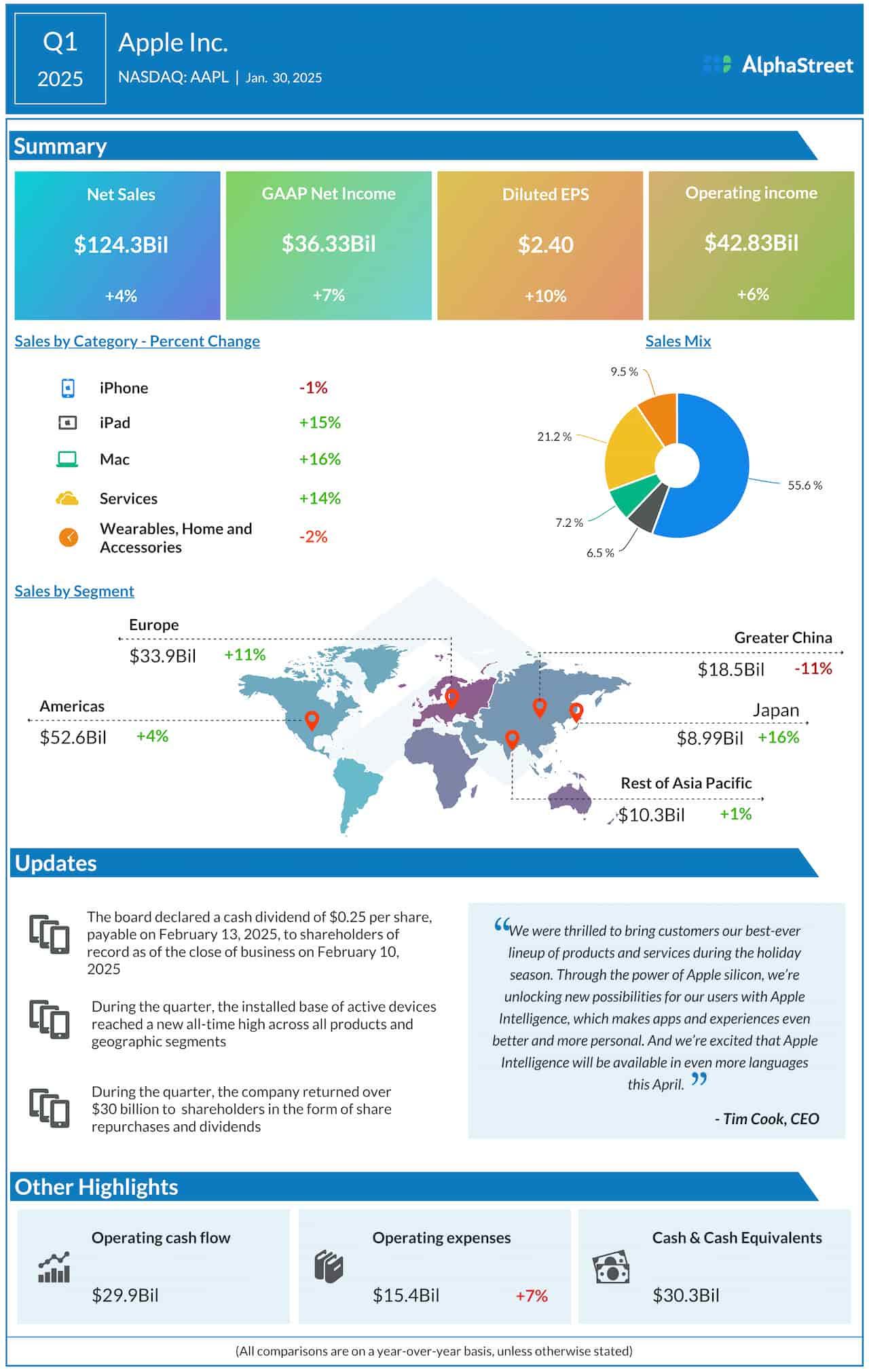

Apple’s recent earnings report shed light on its notable resilience amid a shifting tech landscape. Revenue growth has been driven by a robust performance in services, which includes the App store, Apple Music, and Apple TV+. This segment continues to show promise, gaining traction among consumers seeking digital solutions. The increasing transition to subscription-based models has also contributed significantly to the bottom line. Additionally, despite facing supply chain challenges, Apple has managed to balance production and demand effectively, leading to a substantial increase in device sales.

Market reactions to Apple’s earnings reveal a cautious optimism among investors. Following the announcement, the stock experienced moderate fluctuations reflecting mixed sentiments. Key factors influencing these reactions include:

Moreover, analysts remain divided on whether Apple’s current valuation reflects its future potential, with some arguing for a bullish outlook based on its innovative pipeline.as the company moves forward, the focus will likely shift to how it navigates economic challenges while leveraging its customer loyalty and brand strength.

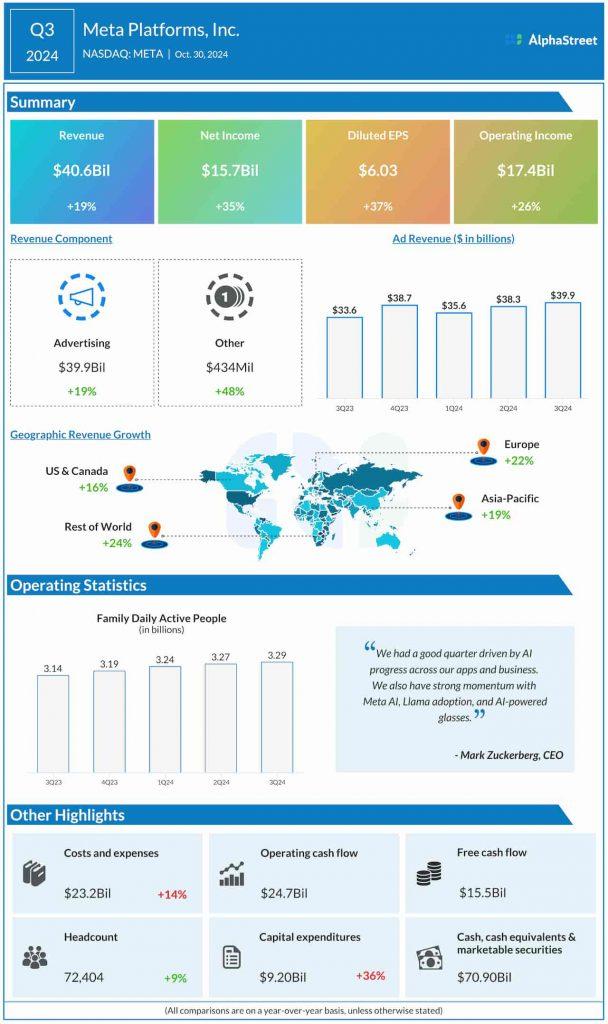

Amidst a rapidly evolving digital landscape, Meta has demonstrated remarkable resilience in its financial performance, even when faced with multifaceted challenges. The company has experienced fluctuations in user engagement and advertising revenues, yet it continues to tap into significant opportunities within virtual and augmented realities, as well as robust growth in its messaging services. Some key factors contributing to its performance include:

In the latest earnings report, meta showcased a positive trajectory by focusing on diversified revenue streams, overcoming obstacles posed by regulatory scrutiny and market saturation. This commitment to innovation is reflected in their investments in AI and commerce, which are anticipated to drive future growth. Below is a summary of Meta’s Q3 financial highlights:

| Metric | Q3 2023 | Q2 2023 | Year-over-Year Growth |

|---|---|---|---|

| Revenue (in billions) | $29.0 | $28.5 | +12% |

| Net Income (in billions) | $6.5 | $6.0 | +15% |

| Monthly Active Users (in billions) | 3.0 | 2.9 | +8% |

As earnings season unfolds, investors need to tread carefully and strategically. The reports from tech giants like Apple and Meta can serve as a double-edged sword, presenting both opportunities and risks. Here are a few recommendations to consider:

Additionally,a careful analysis of key metrics can sharpen your investment decisions. Consider the following table that highlights critical indicators from Apple and meta’s previous earnings:

| Company | Revenue Growth | EPS (Earnings Per Share) | market Reaction |

|---|---|---|---|

| Apple | +5% | $1.24 | ↑ 3% |

| Meta | +10% | $1.50 | ↓ 2% |

By integrating these insights into your investment playbook, you increase your chances of navigating the turbulent waters of earnings season with greater confidence.

As we examine the evolving landscape of technology, Apple and Meta serve as key indicators of broader market dynamics. Their recent earnings reports unveil not just performance metrics, but also the strategic pivots they’re taking to navigate an increasingly competitive habitat. Both companies are focusing on innovative product offerings and diversified revenue streams, signaling a shift toward sustainability in the tech sector.investors are particularly intrigued by Apple’s venture into augmented reality and meta’s ongoing investment in the metaverse, suggesting that defining the future of user experience might hinge on these technological advancements.

Moreover, the data from their earnings calls reveals valuable insights into consumer behavior and market trends. Analyzing the key performance indicators can unearth patterns that suggest where the industry is headed next. Below is a summary of vital metrics:

| Company | Q3 Revenue | Year-over-Year Growth | Key Focus Areas |

|---|---|---|---|

| Apple | $83.4B | 8% |

|

| Meta | $32.0B | 11% |

|

As we close the curtain on this bustling week in earnings announcements, Apple’s and Meta’s financial performances take center stage, illuminating the complex dance of innovation and market dynamics. Their results not only provide a glimpse into their respective futures but also reflect the broader shifts within the tech landscape. investors and analysts alike are left sifting through the implications of these reports, weighing the promises of growth against the realities of a changing economy. While this week’s revelations may fade into the background, the insights gleaned are sure to resonate as we navigate the remainder of the earnings season and beyond. Stay tuned, as we continue to uncover the narratives shaping the markets, one earnings call at a time.