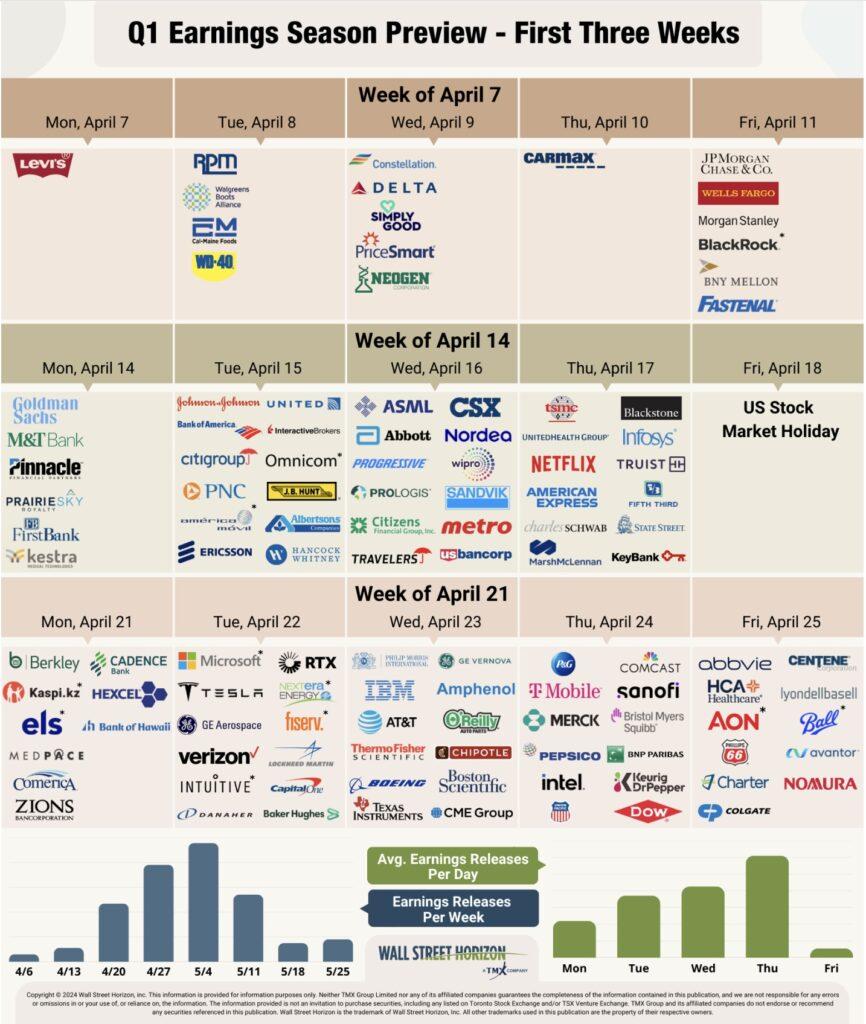

As the financial spotlight turns once again to the tech giants that shape our digital landscape, this week marks a pivotal moment for investors, analysts, and tech enthusiasts alike. The much-anticipated earnings reports from the ‘Splendid Seven’—Microsoft, Meta, Apple, Amazon, and their counterparts—are set to reveal not just the health of these powerhouse companies, but also the broader economic sentiments tethered to innovation and consumer behavior. With each of these titans wielding immense influence over their respective sectors, their quarterly results will provide keen insight into trends that could redefine our interactions with technology. As the curtain rises on earnings week, we invite you to delve into what to expect from these industry leaders and the implications their financial performances may hold for the tech landscape and beyond.

The upcoming earnings reports from the tech giants provide a golden opportunity to gauge their financial health and future trajectory. Analysts will be keenly examining metrics such as Revenue Growth, Earnings Per Share (EPS), and Operating Margins. These indicators will not only reveal how well each company has performed over the last quarter, but they also set the stage for understanding their market position and strategic direction. Pay special attention to any shifts in Revenue by Segment, as this can indicate emerging trends or challenges in specific areas of their business.

Additionally,don’t overlook the importance of Forward Guidance. Companies ofen utilize earnings calls to provide insights into their expectations for the upcoming quarters, which can be pivotal in influencing stock prices. Metrics like Cash Flow and Debt Levels are essential in assessing their operational efficiency and financial stability. Each firm’s response to broader economic conditions,especially in regard to Cost Management and investment in R&D,will provide valuable insights into their long-term growth prospects.

| Key Metrics | Importance |

|---|---|

| Revenue Growth | Indicates business expansion and market demand. |

| Earnings Per Share (EPS) | Measures profitability on a per-share basis. |

| operating Margins | Reflects the efficiency of core business operations. |

| Forward Guidance | Sets market expectations for future performance. |

The upcoming earnings reports from the tech powerhouses promise to reveal insights into their evolving strategies and financial health.Microsoft continues to pivot its strategy towards cloud services and subscription-based models. With platforms like Azure leading the charge,investors will be keen to see if this trend remains strong in the latest quarter. Meanwhile,Meta appears to be doubling down on its metaverse ambitions,hinting at notable investments in VR and AR technologies. This will further test the company’s resilience in a fluctuating ad market, raising questions about user engagement and revenue sustainability.

On the hardware front, Apple is set to showcase how its latest product launches have impacted revenue, especially with the anticipated sales of the iPhone 15 series. Analysts are particularly interested in the balance between hardware sales and services revenue, which has become a critical growth driver. Simultaneously, Amazon is navigating the complexities of its e-commerce business while expanding its footprint in advertising and cloud computing. With the retail sector recovering, stakeholders will be on the lookout for any signs of betterment in profit margins and customer loyalty initiatives.

| Company | Main Revenue Sources | Growth Strategy Focus |

|---|---|---|

| Microsoft | Cloud services, software subscriptions | AI integration, enterprise solutions |

| Meta | digital advertising, virtual reality | Metaverse development, user engagement |

| Apple | Hardware sales, services | Product innovation, ecosystem expansion |

| Amazon | E-commerce, cloud computing, advertising | Supply chain optimization, market expansion |

As the earnings reports for tech giants like Microsoft, Meta, Apple, and Amazon loom, investors are keenly analyzing the potential impacts on market dynamics. A variety of factors are likely to influence investor sentiment, such as expected revenue growth, new product launches, and shifts in market strategy. The anticipation surrounding the “magnificent seven” often leads to heightened volatility, creating both opportunities and risks. Many investors are adopting a cautious stance, keeping a close eye on the guidance these companies provide, while others are ready to capitalize on any post-earnings movements. Key aspects to consider include:

In a possible scenario post-earnings release,companies exceeding expectations could see rapid share price inflations,while those falling short may suffer immediate sell-offs. To illustrate these potential shifts, we present a brief summary that highlights anticipated earnings per share (EPS) and analyst forecasts:

| Company | Expected EPS | Analyst Consensus |

|---|---|---|

| Microsoft | $2.45 | Buy |

| Meta | $3.15 | hold |

| Apple | $1.68 | Buy |

| Amazon | $0.87 | Strong Buy |

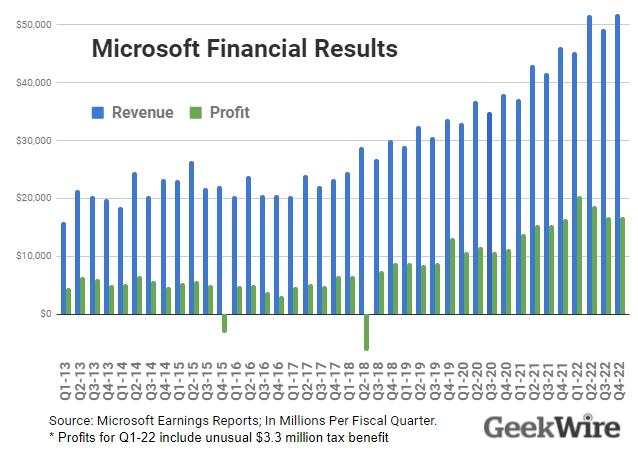

As we approach this pivotal week for the tech giants, investors should focus on several key strategies to capitalize on the earnings reports of Microsoft, Meta, Apple, and Amazon.First and foremost, it’s vital to analyze past performance trends of these companies, particularly their revenue growth and profit margins in the past quarters. Understanding how each company managed challenges like supply chain disruptions and market competition can provide insights into future stability. A comparison of last quarter’s earnings with the forecasts this quarter will yield a better viewpoint on potential fluctuations in stock prices.

Investors should also watch for guidance provided by executives during the earnings calls. This includes insights into future product launches, shifts in market strategy, and anticipated challenges that may impact growth. In addition, keeping an eye on the economic environment and consumer sentiment is crucial. As factors such as inflation and changing buyer preferences play a significant role, consider potential impacts on these tech titans. To summarize:

As we eagerly await the numbers to roll in from the Tech Giants—Microsoft, Meta, Apple, and Amazon—the stakes have never been higher. Each report promises insights not only into the companies’ individual performances but also into the broader trends shaping the technology landscape. Investors, analysts, and tech enthusiasts alike will be glued to their screens, dissecting every figure and interpreting the narratives behind the data.

The upcoming earnings announcements will serve as a barometer for the industry, reflecting both successes and challenges in a rapidly evolving market. Will we witness soaring revenues or cautionary tales of market fluctuations? As we prepare for this pivotal week, remember that these results are more than just quarterly figures; they’re a glimpse into the future of innovation, consumer behavior, and the economic currents that affect us all. Stay tuned—this financial showdown promises to be as riveting as the technology these companies create.