In the ever-evolving landscape of technology and finance, the interconnections between major players often reveal deeper insights into market dynamics. As Alphabet unveils its latest earnings report, the implications ripple far beyond its own balance sheet, reaching into the realms of Meta Platforms and the burgeoning AI chip sector. What do these figures signal for a company redefining social connectivity and the digital experience? And how might these developments impact investors in AI chip stocks, which are increasingly becoming the backbone of today’s technological innovations? In this article, we will explore the intertwined narratives of Alphabet’s financial performance, its repercussions for Meta, and the broader significance for the companies powering the AI revolution. Buckle up as we delve into the numbers and narratives that might shape the future of technology investment.

Alphabet’s recent earnings report highlights the evolving dynamics in the AI sector, notably affecting major players like Meta Platforms. As Alphabet demonstrates robust revenue growth fueled by AI advancements, it reinforces the necessity for competitors to innovate and recalibrate their strategies. The rise in AI investments is prompting companies to focus on developing proprietary technologies, thereby influencing the competitive landscape. Critically important considerations include:

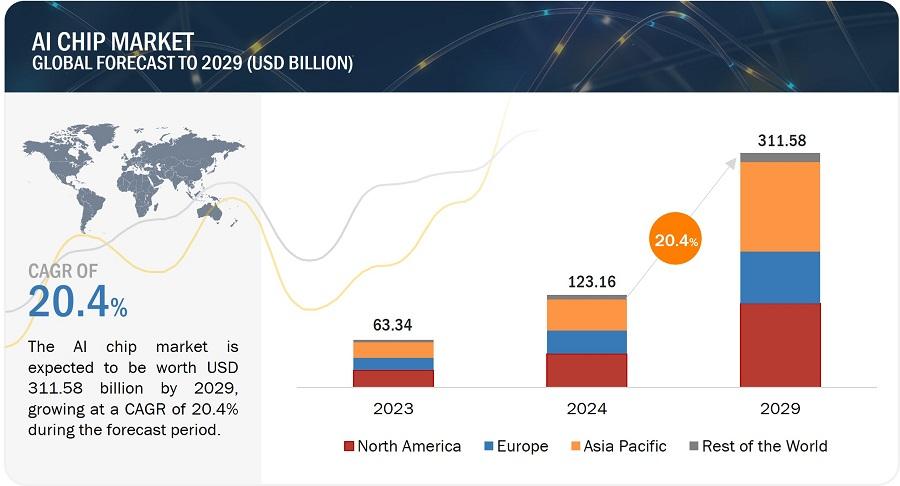

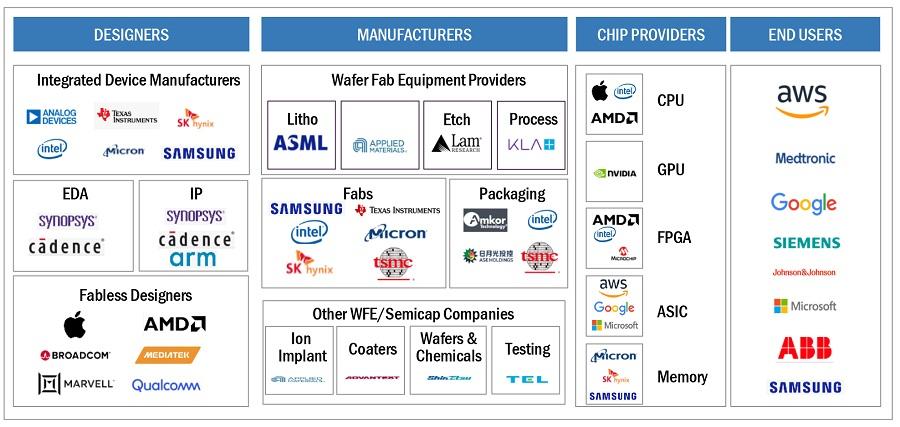

Moreover, the implications extend to AI chip stocks, which are vital for driving the technology foundation of AI solutions.Investors should examine how Alphabet’s earnings influence the supply chain and demand for AI chips. Companies like NVIDIA and AMD play a pivotal role in this space. A summary of these relationships and stocks impacted is as follows:

| Company | impact from Alphabet’s Earnings | Investment Opportunity |

|---|---|---|

| NVIDIA | Boosted by demand for AI chips | High potential for growth |

| AMD | Adapting to new market trends | Moderate potential, watch closely |

| Intel | Need for innovation and repositioning | Speculative investment |

Alphabet’s recent earnings report has cast a spotlight on the tech sector, particularly on companies like Meta Platforms that are navigating through a shifting landscape. With Alphabet showcasing significant growth driven by its cloud services and advertising revenues, it raises critical questions about the strategies Meta must adopt to remain competitive. As Meta seeks to pivot towards AI and new technologies, understanding where Alphabet excels offers valuable insights. Investors should consider:

The ramifications for AI chip stocks also emerge from Alphabet’s performance. As data processing needs surge with AI integrations, companies supplying AI chips could see increased demand reflecting Alphabet’s commitment to innovation. This trend suggests that:

| Company | Projected Growth | AI Chip Demand factor |

|---|---|---|

| NVIDIA | 25% | High |

| AMD | 20% | Moderate |

| Intel | 15% | Low |

The intersection of Alphabet’s financial maneuvers and their implications for chipmakers underscores a pivotal moment for investors. Companies like Meta must not onyl harness innovation but also adapt to rapidly evolving market expectations dictated by larger players in the tech sphere. Monitoring these shifts will be essential for forecasting profitability and future growth trajectories.

The recent earnings report from Alphabet has sent ripples through the AI industry, highlighting both the burgeoning opportunities and the inherent risks tied to AI chip production. As Alphabet continues to innovate and endorse its AI initiatives, the demand for advanced chip technology is poised to escalate. Companies like Meta Platforms need to recalibrate their strategies in response to these market shifts, particularly as competition intensifies for talent, technology, and consumer attention. Potential opportunities in this landscape include:

However, the risks associated with this explosive growth cannot be overlooked. With increased demand, there is a looming concern about supply chain inefficiencies and competitive saturation. Chip manufacturers may struggle to keep pace with rapid technological advancements, leading to potential performance bottlenecks. Key risks include:

As tech giants like Alphabet continue to report robust earnings,investors must assess the potential ripple effects on related sectors,particularly AI chip stocks. Alphabet’s notable results are indicative of broader trends in AI and cloud computing, signaling substantial growth across the board. For investors, this highlights an opportunity to leverage insights from two of the most significant players in the technology sector.By analyzing how Alphabet’s advancements in AI translate into increased demand for computing power, it becomes evident that AI chip manufacturers could see a surge in revenue, prompting a closer look at key players in this niche.

To effectively capitalize on this trend, investors should consider a multifaceted approach. Investing in AI chip stocks requires evaluating not only current earnings reports but also future forecasts and market dynamics. Focus on companies that exhibit strong partnerships with tech giants, as well as those actively innovating in AI chip design and manufacturing. key strategies might include:

additionally, establishing a clear framework for evaluating these stocks can prove beneficial. Below is a simplified comparison table of potential AI chip stocks worth considering, featuring their growth prospects and partnerships with larger firms:

| Company | Growth Potential | Key Partnerships |

|---|---|---|

| NVIDIA | High | Alphabet, Microsoft |

| AMD | Moderate | Meta, Google |

| Intel | Stable | Amazon, Google Cloud |

As we draw the curtain on our exploration of Alphabet’s earnings and their implications for Meta Platforms and the broader AI chip market, it becomes evident that the landscape of technology is constantly evolving. Alphabet’s robust performance offers a tantalizing glimpse into the potential of artificial intelligence, leaving Meta to navigate its own path amid intense competition. For investors keeping a keen eye on AI chip stocks, the reverberations of these earnings will likely inform strategies in the coming months.

The intertwining fate of these giants underscores a crucial narrative: the technology sector thrives on innovation, foresight, and the ability to adapt. As we look ahead, the actions taken by Meta and the evolving prospects of AI chip manufacturers will be critical touchpoints to watch. In a world where data drives decisions and insights shape futures, the interplay of these powerhouses will undoubtedly continue to reshape our technological landscape. Stay tuned, as this dynamic saga is far from over, and the next chapter promises to be just as compelling.