As the financial world holds its breath in anticipation of quarterly earnings reports, one name looms larger than the rest: Meta Platforms Inc. (NASDAQ:META). With its innovative strides in the metaverse and a growing portfolio of digital services,Meta stands at a pivotal juncture,where past performance meets future potential. In a landscape teeming with uncertainty, the decision to double down on an investment in Meta before the Q1 earnings report sparks a fascinating debate. What underlying metrics and market dynamics inform this bold stance? Join us as we explore the rationale behind this calculated gamble, dissect the key indicators that could shape its upcoming performance, and consider what it means for investors looking to navigate the ever-evolving digital frontier.

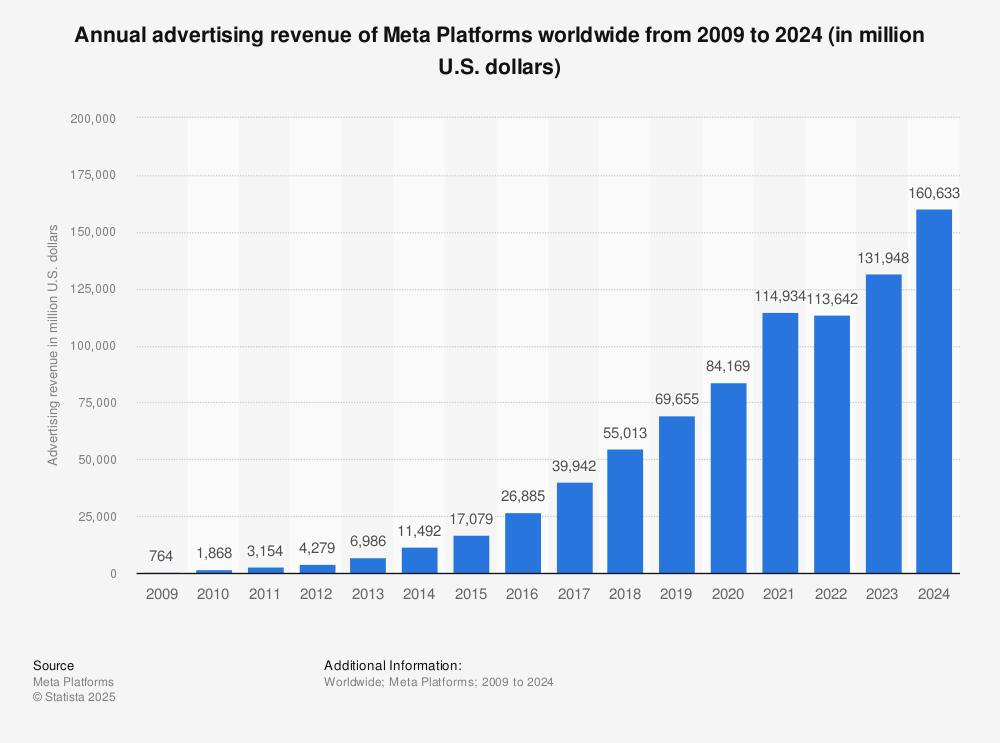

As we edge closer to Q1 earnings, one of the most compelling aspects of Meta’s strategy lies in its innovative approach to advertising revenue.Meta has evolved its advertising model to not just prioritize engagement but to ensure targeted reach through advanced algorithms.The company’s capability to harness vast amounts of user data provides advertisers with a unique opportunity to refine their campaigns, resulting in not only increased effectiveness but also enhanced ROI. This focus on precision targeting has led to a growing number of brands seeking to partner with Meta, thus solidifying its position in the highly competitive digital ad landscape.With content partners increasingly looking for ways to monetize their engagement,Meta’s advertising solutions are well-poised to capitalize on an expanding inventory of ad placements.

Complementing its advanced advertising technology, meta’s continual investment in artificial intelligence enhances its ad offerings. By implementing more robust machine-learning algorithms, the company is capable of delivering ads that resonate better with users, further driving their engagement. Recent findings indicate that advertisers using these enhanced tools reported a 20% increase in conversion rates, showcasing not just potential for growth but solid evidence of its effectiveness. The interplay of creative ad formats and comprehensive analytics provides brands with rich insights into performance, steering them towards long-term commitments with Meta. With its robust growth trajectory, it becomes increasingly clear that the future of Meta’s ad revenue strategy is not just about volume, but about generating lasting revenue streams through highly customized advertising experiences.

As Meta continues to bet on the future of virtual reality (VR) as a cornerstone of its business strategy, the innovations emerging from its Research and Advancement lab are nothing short of groundbreaking.The introduction of the Meta Quest Pro headset has paved the way for a more immersive user experiance, showcasing stunning graphics and enhanced interactivity. Notably, this device leverages advanced technologies such as eye tracking and hand gesture recognition, allowing users to navigate virtual environments with natural ease. Furthermore, innovations like Horizon Worlds, a social VR platform, are setting the stage for new forms of social connectivity, enabling friends and communities to engage in shared experiences beyond geographical limitations.

The company’s relentless focus on integrating VR with social features has unlocked unprecedented opportunities for connection and collaboration. By fostering a sense of presence, users can engage in real-time conversations, attend virtual events, and even collaborate on projects within this digital landscape.Consider the potential of these features:

As we look toward the future, the convergence of VR and social connectivity appears to be the next frontier for Meta, positioning the company at the forefront of a rapidly evolving digital landscape. The stakes are high, but the potential rewards are even greater, making the coming quarters crucial for investors keen on tapping into the expansive possibilities of Meta’s vision.

As we analyze the evolving landscape of social media and technology, several market trends are poised to play a crucial role in shaping Meta’s long-term valuation. increased investment in AI and machine learning technologies is one such trend. Meta’s commitment to integrating advanced AI solutions into their platforms not only enhances user experiences but also optimizes advertising strategies. Consequently, as user engagement continues to rise, we can expect a corresponding increase in advertising revenue, which could significantly bolster Meta’s financial stability. The company is also focusing on diversifying its revenue streams, moving beyond traditional advertising by developing new products and services in virtual and augmented reality, positioning itself as a leader in the metaverse space.

Another key factor influencing Meta’s valuation is changing user demographics and preferences. Younger audiences are gravitating towards platforms that prioritize privacy and authenticity.Meta’s proactive measures to enhance data privacy, coupled with the introduction of features that support user autonomy, are integral to attracting and retaining this demographic. Analyzing Meta’s strategic responses to these shifts reveals a company that is not just responsive but also anticipatory,possibly setting the stage for sustained growth. In addition,trends like social commerce are becoming increasingly notable,with user-generated content driving purchasing decisions. By capitalizing on these trends, Meta is likely to reinforce its market position and enhance its long-term valuation estimates.

As we approach Meta’s Q1 earnings release, several factors indicate a lucrative opportunity for investors looking to enhance their portfolios. First and foremost, meta’s innovative advancements in AI technology and their commitment to expanding the Metaverse provide a robust foundation for sustained growth. Analysts predict an uptick in user engagement and ad revenues due to enhanced AI-driven personalization.Other elements contributing to this optimism include:

Moreover, examining historical performance trends reveals that Meta tends to outperform post-earnings when analysts’ expectations are set modestly. Recent sentiment suggests that expectations for Q1 remain conservative, setting up a potential upside surprise. If we look at the performance metrics surrounding the previous quarters, it becomes apparent that significant rebounds often follow periods of initial skepticism. Below is a summary of previous quarterly performances:

| Quarter | Earnings Surprise (%) | Stock price Movement (%) |

|---|---|---|

| Q4 2022 | +8% | +13% |

| Q3 2022 | +5% | -2% |

| Q2 2022 | -10% | +6% |

as we stand on the precipice of Meta’s Q1 earnings report, the decision to double down on this tech giant reflects a calculated optimism rooted in both the company’s adaptive strategies and the evolving landscape of digital interaction. While the waves of uncertainty in the market can be daunting, there lies a wealth of opportunity for those willing to look beyond the immediate fluctuations. Meta’s commitment to innovation and its expansive vision for the future suggest that, whether navigating through challenges or soaring to new heights, the company is poised to redefine the digital landscape in ways we can only begin to imagine. As investors, staying informed and engaged in the narratives that shape our investment choices will be key. As we await the earnings reveal, the question remains: Are you ready to embrace the potential of what lies ahead?