In the ever-evolving landscape of technology and finance, few stories capture the imagination quite like the rise and resilience of Meta Platforms, Inc.Once a social media titan, the company has set its sights on the transformative potential of artificial intelligence, seeking to redefine itself in a world increasingly driven by data and machine learning. However,as Meta boldly strides into this burgeoning frontier,it faces a significant and looming risk that could overshadow its aspiring plans. This article delves into the intricacies of Meta’s journey, exploring how its AI aspirations are intertwined with potential pitfalls that investors must navigate carefully. As the tech giant aims for the stars, understanding the ground realities is crucial for anyone looking to gauge the true potential of Meta’s next chapter.

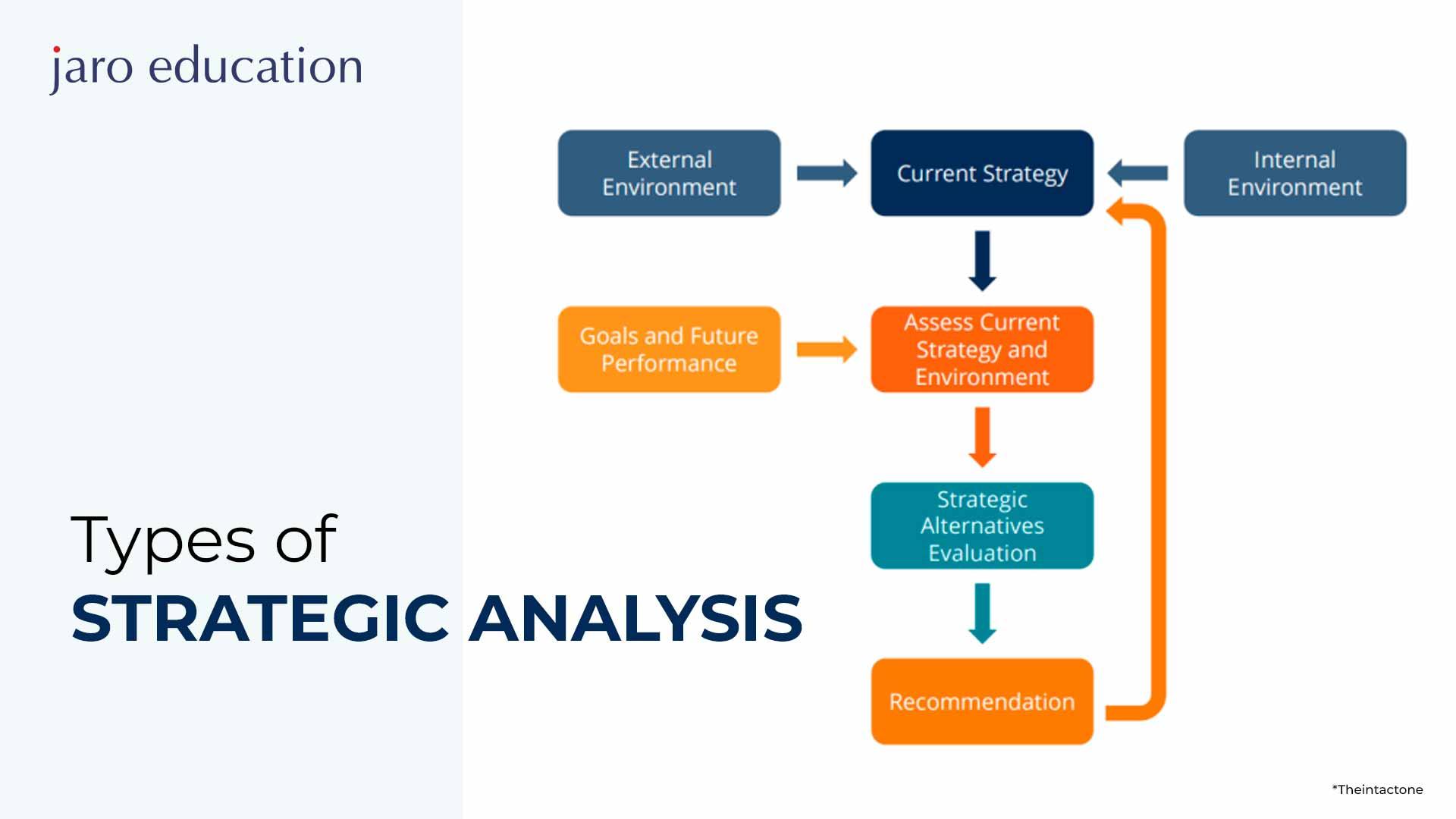

As Meta continues to pivot towards AI, the company faces a multitude of obstacles in its quest to establish itself as a leader in the rapidly evolving technology landscape. Competition is intensifying, with major players like Google, Microsoft, and OpenAI aggressively investing in AI capabilities. Thes competitors not only have significant resources but also established user bases that are difficult to disrupt. Additionally,regulatory scrutiny is becoming increasingly pronounced,as governments worldwide grapple with the ethical implications of AI deployment. Some challenges to consider include:

Moreover, internal alignment within Meta itself presents a significant challenge. The ambitious direction set by leadership must cascade effectively through diverse teams, each with distinct agendas and cultures. The disparity in how AI is perceived across various divisions can lead to fragmented strategies and diluted focus. ensuring that all teams are aligned with a cohesive vision is critical for Meta to harness its technological potential fully. To measure progress, Meta could utilize performance metrics across its AI initiatives, establishing clear benchmarks to reflect success or areas needing adjustment:

| Metric | Current Value | Target value |

|---|---|---|

| User Adoption Rate | 25% | 40% |

| AI Project Completion | 60% | 85% |

The reception of Meta’s recent innovations has been mixed, reflecting both excitement over its advancements and skepticism regarding their long-term viability. Investors have responded enthusiastically to the company’s commitment to artificial intelligence, notably with its focus on enhancing user experience and driving ad revenue. though, various factors have led to a more cautious market outlook:

To gauge the market’s sentiment, analysts have begun to compile metrics that elucidate the depth of investor confidence. Data gathered reveals a polarized view regarding Meta’s future performance, further complex by external variables:

| Metric | Current Value | Investor Sentiment |

|---|---|---|

| Price-to-Earnings Ratio | 25.4 | Moderate Concern |

| Market Capitalization | $800 Billion | optimistic |

| Innovation Index Rating | 7.5/10 | Cautiously Optimistic |

The relationship between consumer sentiment and Meta’s stock performance is increasingly crucial, especially as the company leans towards ambitious AI integration. When consumers perceive a brand positively, it can lead to increased engagement, heightened loyalty, and, ultimately, improved financial performance.Meta’s success hinges not only on its innovation in AI but also on how well it resonates with its user base. A decline in consumer trust or satisfaction could swiftly translate into a negative impact on its financial health and stock valuation. Key factors influencing this dynamic include:

Moreover, the intricate balance between improving technological capabilities and maintaining a positive consumer relationship is critical for investors. A slight dip in sentiment could lead to more significant sell-offs as speculators react to perceived future earnings risks, which may create a ripple affect. To illustrate these potential risks, consider the following table analyzing recent trends in consumer sentiment alongside Meta’s stock performance:

| Time Period | Consumer Sentiment Index | Meta Stock Performance |

|---|---|---|

| Q1 2023 | Positive | +15% |

| Q2 2023 | Neutral | -5% |

| Q3 2023 | Negative | -10% |

to navigate the turbulent waters of stock volatility, especially concerning Meta’s evolving ambitions in AI, a multi-faceted strategy is essential. Investors should consider diversifying their portfolios by including sectors that are less correlated with technology-based stocks, thereby offsetting potential downturns. Additionally, enhancing risk management frameworks will enable better handling of market fluctuations. Key strategies include:

Moreover, staying informed about Meta’s advancements and challenges in AI can lend insights into strategic entry and exit points for investment. Regularly reviewing market analytics and forecasts is vital. Here’s a rapid reference table of key performance indicators (KPIs) to monitor:

| Indicator | Importance | Frequency of Review |

|---|---|---|

| Revenue Growth Rate | Measures financial momentum | Quarterly |

| AI Product Adoption rate | Indicates market receptivity | Monthly |

| Market Sentiment Analysis | Reflects investor confidence | Weekly |

while Meta’s ambitious strides into the AI landscape signal a forward-thinking approach, the looming risks associated with its stock cannot be overlooked. Investors must navigate a complex terrain shaped by regulatory challenges,market volatility,and shifting consumer sentiments. As Meta attempts to redefine its identity in an ever-evolving tech ecosystem, the balance between innovation and caution remains critical. The future may hold exciting possibilities, but a measured outlook will be essential in assessing whether Meta can transform its ambitions into sustainable success. As we move forward, only time will reveal how the intersection of AI and stock performance unfolds in the high-stakes game of the tech industry.