in the fast-paced world of technology and digital innovation, few companies inspire as much intrigue as Meta Platforms, Inc.(NASDAQ:META). As the clock ticks down to a pivotal 84 days,a palpable sense of momentum is brewing around the tech giant,sparking conversations among investors,analysts,and enthusiasts alike. With aspiring projects on the horizon and strategic shifts poised to redefine its trajectory, Meta stands at a crossroads that could significantly impact its stock performance and overall market presence. This article delves into the factors contributing to this momentum, explores what the near future may hold for Meta, and examines how the company’s evolving vision could unfold in this crucial timeframe. Join us as we navigate the key developments and trends shaping the narrative of one of the most influential players in the digital landscape.

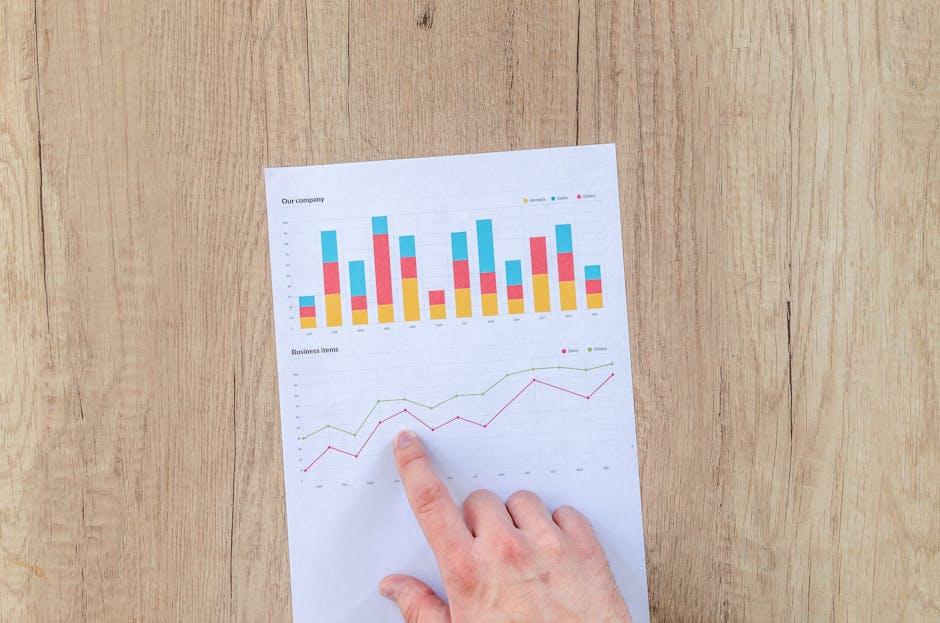

As Meta navigates the ever-evolving landscape of social media and technology, several key indicators will serve as barometers of its growth potential in the coming months. Investors and analysts should concentrate on trends surrounding user engagement, as fluctuations in monthly active users (MAUs) can significantly impact profitability. Additionally, keeping an eye on meta’s investments in the metaverse, along with its advertising revenue, will provide insight into its ability to diversify income streams and sustain long-term growth. Vital metrics to consider include:

Furthermore,it’s essential to monitor Meta’s strategic partnerships and acquisitions,which could accelerate growth and enhance competitive advantage. These initiatives not onyl broaden Meta’s service offerings but also foster synergy across platforms like Facebook, Instagram, and WhatsApp. An evaluation of upcoming earnings reports and guidance provided by the company will also yield critical insights. The following table outlines importent upcoming events that may influence market sentiment:

| Date | Event | Expected Impact |

|---|---|---|

| november 2023 | Q3 Earnings Release | insight into financial performance. |

| December 2023 | Product Launch Conference | Potential for new innovations. |

| January 2024 | Annual Investor Meeting | Future growth strategies discussed. |

The competitive landscape for Meta (NASDAQ: META) is marked by a diverse array of players that challenge its dominance in the social media and digital advertising sectors. Understanding these dynamics is crucial as the company navigates through a rapidly changing ecosystem. The key competitors include:

To further illustrate this landscape, a comparative analysis of user engagement and advertising revenue among these competitors reveals critical insights. Below is a simple table highlighting estimated user engagement metrics across these platforms:

| Platform | Monthly Active Users (in millions) | Average Ad Revenue per User |

|---|---|---|

| Meta Platforms | 2,900 | $12.50 |

| 450 | $9.00 | |

| Snap Inc | 500 | $5.50 |

| TikTok | 1,000 | $7.00 |

| YouTube | 2,200 | $15.00 |

This analysis underscores the challenges Meta faces as it strives to maintain its edge amidst fierce competition and evolving consumer preferences.Strategic adaptations and innovative approaches will be vital for Meta to solidify its position in this multifaceted market.

As Meta continues to build momentum, investors should consider adjusting their strategies to capitalize on projected growth in the coming weeks. Here are some key recommendations:

Moreover, positioning for success requires a proactive approach in understanding the company’s fundamentals and the broader market landscape. Consider the following factors:

| Key Factor | Impact on Investment |

|---|---|

| Regulatory Habitat | Potential risks affecting market sentiment; stay informed about policy changes. |

| Technological Advancements | Opportunities for revenue growth through innovation in AR/VR and social networking. |

| Competition Analysis | Understanding competitors’ moves can help in anticipating market shifts. |

As we look ahead to the coming 84 days, several key factors are expected to bolster Meta’s position in the market. The company’s focus on enhancing user engagement across its platforms, particularly through innovative features in Instagram and WhatsApp, is set to attract a wider audience. This includes:

In addition, Meta’s upcoming earnings report could provide a crucial indicator of its financial health and growth trajectory. Analysts are watching for indicators such as:

| Key Metric | Current value | Projected Value (Next 84 Days) |

|---|---|---|

| Daily Active Users (DAU) | 2.9 Billion | 3.1 Billion |

| Ad Revenue ($ Billion) | $28.5 | $30.0 |

| Operating Margin (%) | 36% | 38% |

As we stand on the cusp of a pivotal moment for Meta, the next 84 days promise to be crucial as momentum builds and the tech giant navigates the intricate landscape of innovation, user engagement, and market dynamics. With strategic shifts and potential breakthroughs on the horizon, investors and observers will be closely watching how the company adapts to evolving challenges and opportunities. It remains to be seen whether this momentum will translate into sustained growth and rejuvenated investor confidence. As we draw the curtain on this discussion, one thing is clear: the coming weeks will serve as a fascinating chapter in Meta’s ongoing story, and how it unfolds could reshape perceptions and fortunes alike. Stay tuned as we monitor these developments and what they might mean for the future of Meta and the broader tech industry.