In the ever-evolving landscape of homeownership, the allure of transforming a house into a dream residence has inspired many to take the plunge into renovation projects. Understanding the growing demand for financial solutions that cater to this ambition, Hanley economic Building Society has stepped forward with an innovative offering: the Home Renovation Mortgage. This new product promises to empower homeowners adn prospective buyers alike, providing them with the necessary resources to breathe new life into their living spaces. In this article, we delve into the details of this initiative, exploring how it aims to simplify the renovation journey and enhance the possibilities for homeowners seeking to personalize their spaces. Whether it’s a small update or a complete overhaul, Hanley Economic Building Society is redefining the path to a dream home, one renovation at a time.

Exploring the Home Renovation Mortgage: A New Opportunity for Homeowners

Homeowners looking to enhance their living spaces now have a fresh avenue to explore with the newly launched Home Renovation Mortgage by Hanley Economic Building Society. This innovative financial product is tailored specifically for those keen on investing in home improvements without the burden of a conventional loan. Individuals can take advantage of competitive interest rates and flexible repayment options, allowing them to embark on projects ranging from minor repairs to significant renovations. With this mortgage, transforming a house into a dream home has never been more accessible.

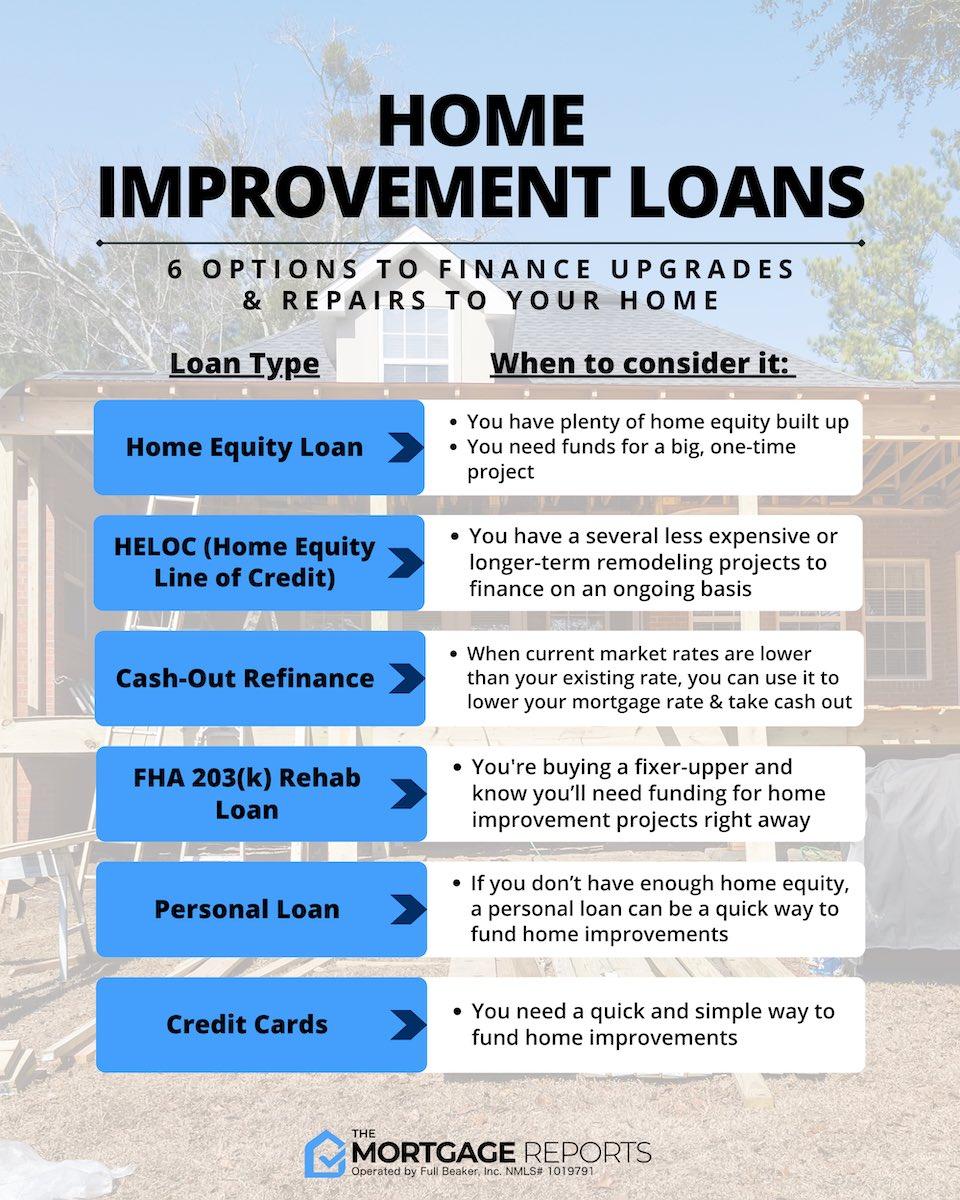

Details surrounding the program are designed with the homeowner’s needs in mind,making it a seamless experience. Key features include:

- Financing Options: Various plans to suit different project budgets.

- Interest Rates: Competitive rates that help minimize financial strain.

- Flexible Terms: Customizable terms to match repayment capacities.

- Speedy approval Process: Streamlined applications for faster access to funds.

This initiative stands to empower homeowners, enabling them to make necessary improvements and increase the value of their properties while enjoying a cozy financial journey.

Key Features of Hanley Economic’s Innovative Mortgage Solution

Hanley economic’s new mortgage solution revolutionizes the way homeowners invest in their properties. This innovative product is designed specifically for those looking to renovate rather than relocate, offering a flexible path to unlocking the full potential of their homes. Key aspects of this mortgage include:

- Customizable Loan Amounts: Borrowers can tailor their loan to meet the exact costs of their renovation projects, ensuring that they only take on what they need.

- Competitive Interest Rates: Enjoy attractive rates that make home renovations more affordable and manageable in the long run.

- Flexible Repayment Terms: Options that allow for customization based on personal financial situations.

- Quick Access to Funds: Streamlined processes that enable homeowners to access funds promptly, helping them capitalize on favorable contractors and market conditions.

- Expert Guidance: Access to in-house financial advisors who provide tailored advice throughout the renovation process.

Additionally, the mortgage seamlessly integrates with an array of services to enhance the homeowner’s experience.Hear’s a simple table showcasing the funding options available:

| Renovation Type | Loan range (£) | Typical Duration |

|---|---|---|

| Kitchen Upgrade | 5,000 – 30,000 | 1 – 3 months |

| Bathroom Remodel | 3,000 – 25,000 | 1 – 2 months |

| Full House Renovation | 20,000 – 100,000 | 3 – 6 months |

This extensive approach not only simplifies the renovation financing process but also helps uplift the overall value and aesthetics of homes, making it a win-win for homeowners looking to enhance their living spaces while maintaining financial stability.

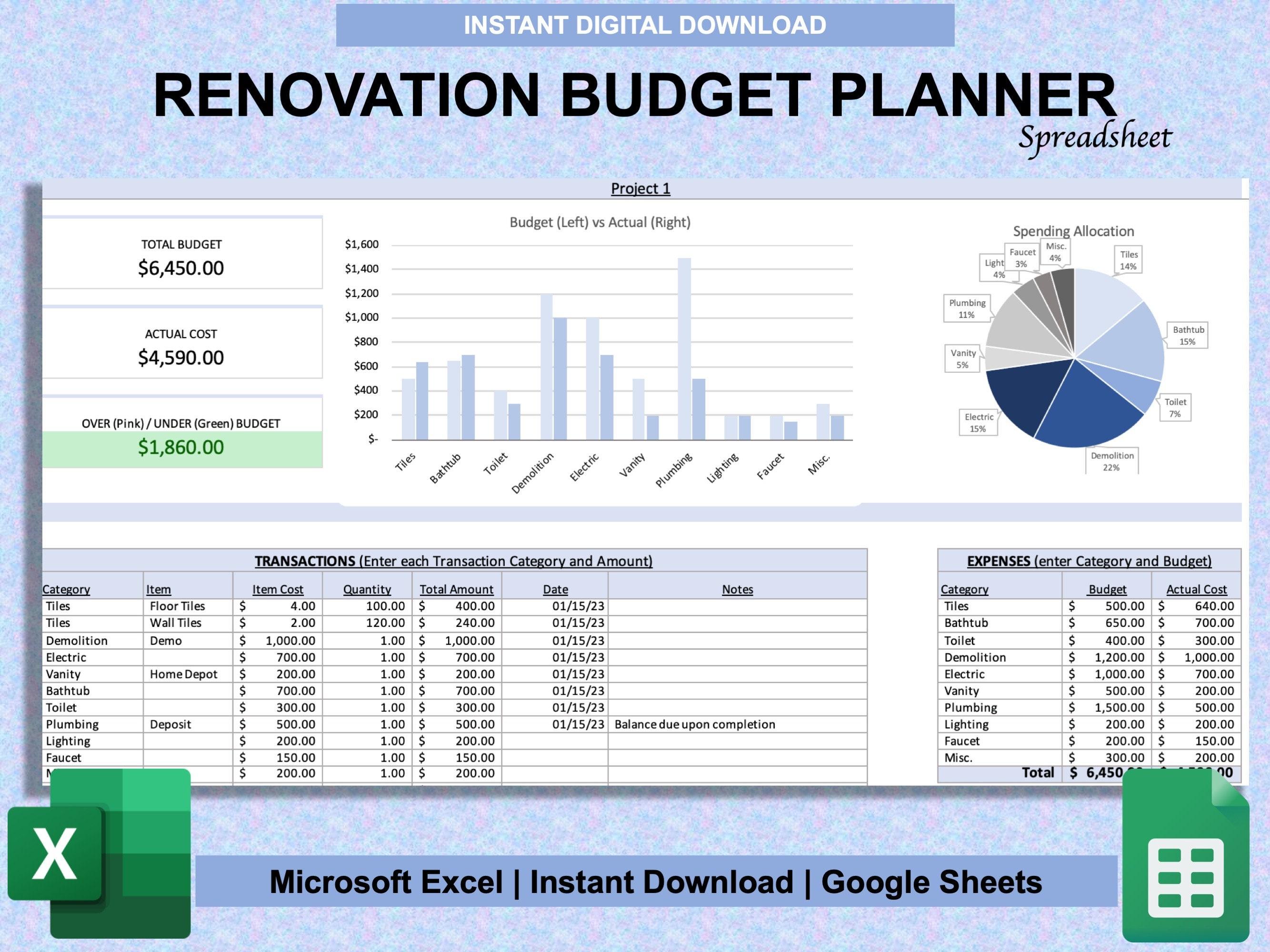

Maximizing Your Renovation Budget: Tips for Homeowners

To stretch every dollar of your renovation budget, prioritize your projects based on necessity and potential value. Start by identifying which improvements will add the most value to your home, such as kitchen remodels or bathroom upgrades. conduct thorough research on the costs and benefits associated with each project. Engage with various professionals for detailed quotes to avoid any surprises. don’t forget to factor in the cost of materials versus the advantages you’ll gain. By allocating your budget wisely, you’ll ensure that your investments yield the best return.

Additionally, consider integrating DIY elements into your renovation plan, which can significantly reduce labor costs. Host a brainstorming session with family and friends were you can share ideas and gather skills. Explore options to source materials at lower costs, such as online marketplaces or local auctions. Here’s a quick overview of potential budget allocations:

| Project Type | Estimated Budget (%) |

|---|---|

| Kitchen Renovation | 25% |

| Bathroom Upgrade | 20% |

| Living Room Update | 15% |

| Exterior Improvements | 10% |

| Miscellaneous & Contingency | 10% |

| DIY Projects | 10% |

By spreading your investments evenly across different areas, you’ll not only enhance the overall appeal of your home but also enhance its marketability.

Navigating the Application Process: Steps to Secure Your Home Renovation Mortgage

Embarking on the journey to secure a mortgage for your home renovation can seem daunting, but with careful planning and decisive action, you can streamline the process. Start by gathering essential documents,such as proof of income,tax returns,and details of your current mortgage,if applicable. This preparation will not only save time but also help the lender assess your financial situation more effectively. Additionally, consider outlining your renovation plans to present a clear picture of your project’s scope and costs, enhancing your application’s credibility.

Once your documents are in order, take the next step by reaching out to Hanley Economic Building Society to inquire about their specific requirements for the Home Renovation Mortgage.Be sure to check for eligibility criteria which may include credit score minimums, debt-to-income ratios, and more.After confirming your eligibility, fill out the application form accurately and comprehensively. Don’t hesitate to ask questions throughout the process; lenders are there to assist you. once your application is submitted, stay proactive by following up regularly to ensure nothing is overlooked as your mortgage gets processed.

Future Outlook

As we conclude our exploration of Hanley Economic Building Society’s innovative Home Renovation Mortgage, it’s clear that this new offering provides a fresh approach to home enhancement financing. By understanding the unique needs of homeowners looking to enhance their living spaces, Hanley Economic paves the way for transformative projects that breathe new life into homes. This initiative not only empowers individuals to realize their renovation dreams but also reinforces the society’s commitment to supporting community growth and personal investment. As the housing market continues to evolve, we look forward to seeing how such tailored offerings can foster both individual satisfaction and broader economic growth.Whether you’re contemplating a minor update or a complete overhaul, this mortgage option could be the key to unlocking your home’s full potential.