Meta Eyes Stablecoins Again as US Regulatory Landscape Shifts

As the digital currency landscape continues to evolve,the nexus between innovation and regulation is becoming increasingly intricate. In recent months, Meta, formerly known as Facebook, has onc again turned its gaze towards stablecoins, navigating a path marked by both chance and uncertainty. with the United States regulatory framework undergoing notable changes, the tech giant is poised to reassess its ambitions in the realm of cryptocurrency—a sphere it initially ventured into with high hopes and subsequent lessons. This article explores Meta’s renewed focus on stablecoins, the implications of shifting regulations, and what it means for the future of digital currencies in the U.S. market. As the dialog around financial technology and consumer protection intensifies,can meta strike the right balance between innovation and compliance? Let’s delve into the key factors at play.

As regulatory frameworks worldwide adapt to the growing influence of digital assets, Meta has recommenced its exploration of stablecoins, recognizing their potential to enhance user engagement and streamline transactions across its platforms. Investors and users alike are keenly observing how these digital currencies can provide stability within the volatile cryptocurrency market. Key factors driving meta’s renewed interest include:

Through this renewed focus, Meta can harness the advantages stablecoins offer, fostering a more versatile digital economy. Analysts believe that as Meta works to align its stablecoin initiatives with regulatory requirements, it could pave the way for innovative services that meet both compliance standards and user expectations. This strategic pivot may not only reposition Meta as a leading player in the digital currency space but also ignite competition among other tech firms aiming to capitalize on the evolving financial landscape.

| Factor | Impact on meta |

|---|---|

| Regulatory Clarity | Encourages innovation and reduces uncertainty. |

| Consumer Interest | Drives platform engagement through new features. |

| Business Strategy | Establishes Meta as an industry leader in finance tech. |

The recent shift in the US regulatory landscape has opened new pathways for tech giants like Meta to reconsider their stance on stablecoins. As legislators and financial institutions grapple with establishing a extensive framework for digital currencies, the potential for innovation is both promising and precarious. This dynamic environment presents unique opportunities for companies to develop and integrate stablecoin solutions that could redefine digital transactions. the key considerations for businesses navigating this terrain include:

Additionally, establishing partnerships with existing financial institutions may prove favorable as a way to leverage established trust and reach broader audiences. As Meta assesses the feasibility of launching new stablecoin initiatives, variables such as regulatory forecasts and public sentiment will play vital roles in shaping their strategies. The shifting landscape has already led to discussions around the following:

| aspect | Status |

| Regulatory Clarity | In progress |

| Market Readiness | Growing interest |

| technological Infrastructure | Developing |

| Public Trust | Building |

As Meta repositions itself to explore the development of stablecoins, various strategic considerations will play a crucial role in shaping its approach. first and foremost, regulatory compliance remains at the forefront of these considerations. Navigating the evolving landscape of financial regulation in the U.S., especially in light of potential legislative changes, will require Meta to foster collaborative relationships with regulatory bodies. This can be achieved through proactive engagement and transparency, which can help mitigate concerns around consumer privacy, anti-money laundering, and other regulations that govern digital currencies.

Moreover, the integration of stablecoins within Meta’s ecosystem should focus on user experience and interoperability. The goal is to create seamless transactions across its platforms, such as WhatsApp, Instagram, and Facebook. To accomplish this, Meta might consider the following strategies:

By prioritizing these elements, Meta can position its stablecoin as a viable solution for users seeking reliable and efficient digital payment methods.

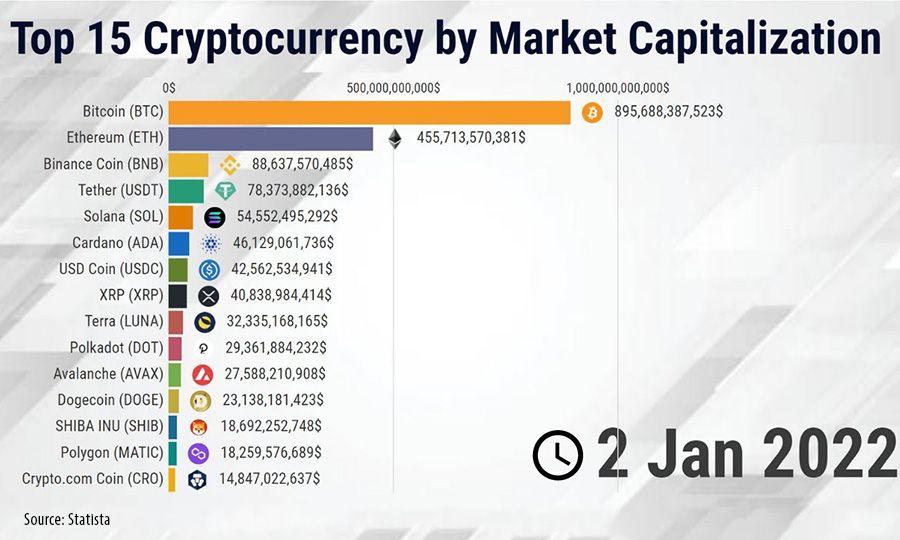

The recent shift in the U.S. regulatory landscape has reopened discussions around the potential of stablecoins and their impact on the broader cryptocurrency market. As major players like Meta reconsider their strategies, the possibility of integrating digital currencies into everyday financial transactions is becoming more tangible. Stablecoins, with their promise of reduced volatility and greater reliability, hold the potential to transform how individuals and businesses manage digital assets. Key implications include:

This evolving landscape presents opportunities for innovation within digital finance, likely to spur advancements that drive user engagement and trust.With stablecoins at the forefront, financial products may evolve to harness the unique features of blockchain technology, creating new ecosystems for transactions, lending, and savings. The following table illustrates potential innovations inspired by the rise of stablecoins:

| Innovation Area | Description |

|---|---|

| payment Solutions | Instant cross-border payments with reduced fees. |

| Decentralized finance (DeFi) | More accessible lending and borrowing platforms. |

| Automated Savings | Smart contracts that facilitate interest-bearing accounts. |

As the regulatory landscape in the United States continues to evolve, Meta’s renewed interest in stablecoins marks a significant turning point in the intersection of technology and finance. With a careful eye on compliance and innovation, the tech giant is poised to navigate the complexities of this emerging sector. The potential benefits of stablecoins—stability, accessibility, and efficiency—could redefine how digital transactions are conducted in an increasingly digital economy. As Meta explores these avenues, stakeholders, regulators, and consumers alike will need to remain vigilant and informed, ready to adapt to the transformative possibilities that lie ahead. The journey is just beginning, and the implications of these developments resonate well beyond the confines of corporate strategy, hinting at a future where digital currencies could become an integral part of our daily lives. As we watch this space, one thing is clear: the conversation around stablecoins is far from over.