In the ever-evolving landscape of corporate governance and shareholder engagement,regulatory filings often serve as critical windows into the operational strategies and financial maneuvers of major companies. One such document that has recently captured attention is the SEC Form PX14A6G, filed by none other than Meta Platforms Inc.,the tech behemoth reshaping how we connect and interact in the digital age. This filing is not merely a bureaucratic obligation; it represents a pivotal moment in Meta’s ongoing journey of transformation and adaptation in a world where transparency and shareholder sentiment are paramount. In this article,we will delve into the details of the PX14A6G,examining its implications for both Meta and its stakeholders,and offering insights into how such filings reflect broader trends within the tech industry and corporate governance as a whole.Join us as we unpack the nuances of this significant regulatory submission and its potential impact on the future of a company that continues to redefine the boundaries of social media, virtual reality, and beyond.

SEC Form PX14A6G is a crucial filing that sheds light on the governance and shareholder engagement strategies of public companies, particularly Meta Platforms Inc. This form is utilized by proponents of shareholder resolutions to ensure that their proposals are brought forth for a vote at the annual shareholder meeting. The implications of filing this form extend beyond mere compliance; they provide a platform for shareholders to express their concerns and advocate for changes that align with their interests and values. This process not only fosters transparency but also empowers investors to have a direct say in the strategic direction of the company.

the importance of this form is amplified as it highlights the dynamic between shareholders and corporate management. By examining the details of Form PX14A6G, one can glean insights into the key issues at stake, the nature of proposed resolutions, and the potential impact on governance. Consider the following aspects that encapsulate the purpose of this filing:

Meta Platforms Inc. continues to reshape its strategic narrative through its latest SEC filing. The document reveals ample updates regarding shareholder initiatives, signaling a proactive approach to governance and transparency. Key takeaways include:

Beyond governance, the filing also showcases Meta’s financial resilience amid shifting market dynamics. The strategic focus on innovation and diversification plays a pivotal role in sustaining growth. Notable highlights include:

| Aspect | Details |

|---|---|

| Revenue growth | Projected increase of 20% year-over-year. |

| User Engagement | Monthly active users exceeded 3 billion. |

| Investment in AR/VR | $10 billion earmarked for immersive technology over the next five years. |

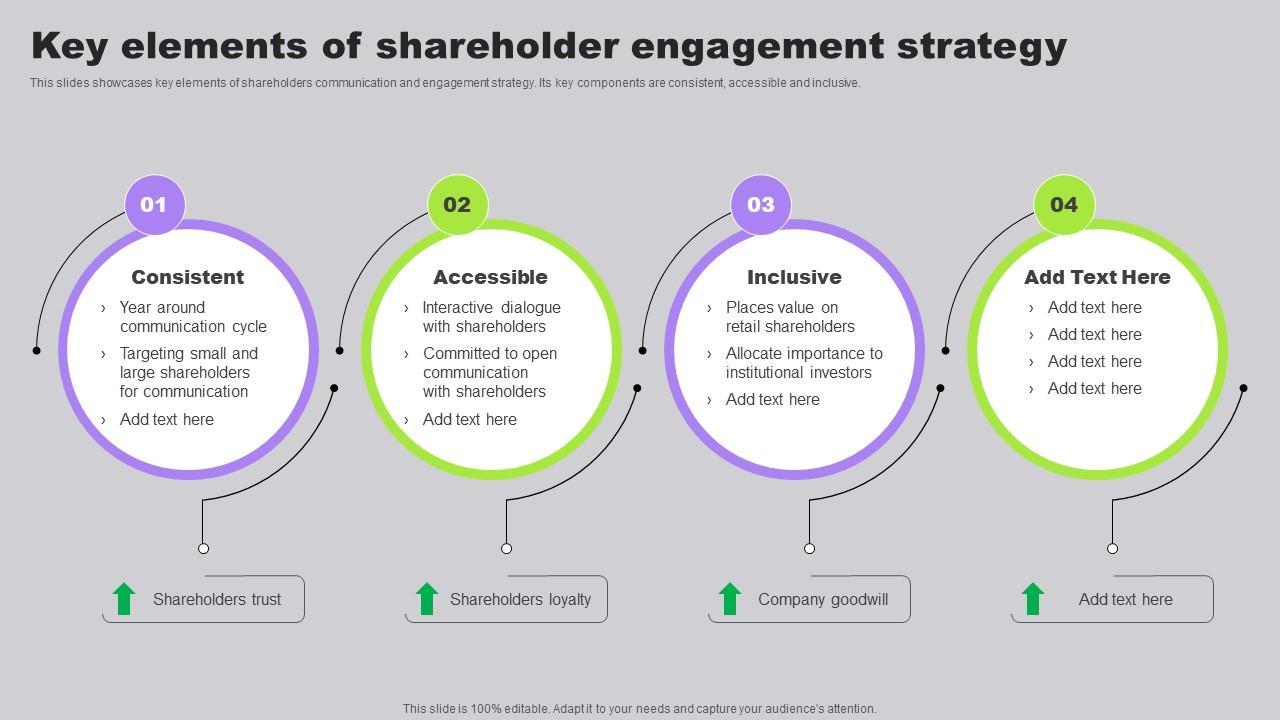

In an era characterized by rapid change and increasing scrutiny, companies are reevaluating their approaches to shareholder engagement. The recent filing of SEC Form PX14A6G by Meta Platforms Inc.serves as a prime example of how corporations are adapting to not only satisfy regulatory requirements but also to foster genuine dialogue with their investors. This form, designed to provide insights into shareholder proposals and corporate governance matters, highlights the importance of transparency and responsiveness in communication strategies. As stakeholders demand more from organizations, a proactive engagement approach is essential for building trust and ensuring alignment on key issues.

To effectively navigate this shifting landscape, companies are leveraging a variety of innovative engagement tactics, including:

| Engagement Strategy | Benefits |

|---|---|

| Virtual Town Halls | Enhances transparency and real-time dialogue. |

| Focused Investor Relations | Improves tailored communication and relationship building. |

| Regular Reporting | Builds credibility and trust through consistent updates. |

As evidenced by Meta’s recent maneuver, companies must not only comply with traditional regulatory frameworks but also embrace forward-thinking strategies that resonate with shareholders. By employing these engagement techniques, organizations can transform their shareholder relations from mere compliance activities into robust partnerships that contribute to long-term sustainability and growth.

In the wake of Meta’s recent disclosure through SEC Form PX14A6G, stakeholders must recalibrate their strategies to align with the broader context of the digital landscape. It is essential to engage in proactive communication to establish transparency and trust with users and investors. Key actions to consider include:

Moreover, aligning organizational goals with stakeholder expectations can enhance resilience and adaptability. by addressing potential concerns raised by the disclosure, stakeholders should focus on forging stronger partnerships and collaborations. Recommended initiatives include:

| Action item | Expected Outcome |

|---|---|

| implement feedback mechanisms | Improved customer satisfaction |

| Review risk management strategies | Enhanced organizational resilience |

| Encourage stakeholder forums | Strengthened community engagement |

the recent filing of SEC Form PX14A6G by Meta Platforms Inc. marks a significant chapter in the company’s ongoing narrative. As organizations navigate the intricate world of corporate governance and shareholder engagement, this form sheds light on Meta’s strategies to align itself with shareholder interests and foster open communication. By understanding these regulatory moves, investors and stakeholders can better appreciate the nuances of Meta’s operational landscape and its implications for future growth. As the tech giant continues to evolve, keeping an eye on such filings will be essential for anyone looking to grasp the broader implications for both Meta and the industry as a whole.