In a buoyant session, the Nasdaq surged ahead, buoyed by reassuring earnings from tech giants Microsoft and Meta. As optimism spreads, the S&P 500 and Dow also lifted, reflecting a renewed confidence in the markets and a hopeful outlook for investors.

Mark Zuckerberg’s vision for Meta aims to transcend its roots, aspiring to become a social hub of the metaverse. Yet, despite ambitious plans, critics argue it’s still tethered to its core identity as an advertising behemoth, focused on monetization.

Mark Zuckerberg envisions Meta as a digital utopia, aiming to transform social engagement through the metaverse. Yet, critics argue that the platform’s current identity struggles to align with this ambitious vision, raising questions about its true purpose.

In a surprising twist, Meta, Amazon, and Google face allegations of manipulating crucial AI rankings, raising concerns about transparency and fairness in the tech landscape. As scrutiny intensifies, the implications for innovation and competition are profound.

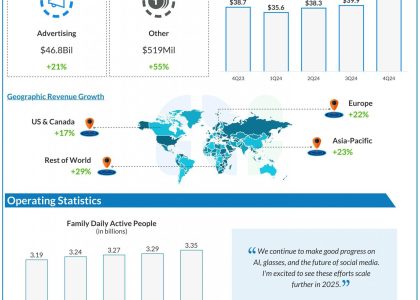

In a remarkable start to the year, Meta has surpassed expectations in Q1, driven by robust advertising performance. This growth showcases the company’s ability to adapt and innovate in the digital landscape, reflecting a resilient business model.

As tech giants Meta and Microsoft unveil strategic innovations and robust financial results, investors are rekindling their enthusiasm for Big Tech. Promising advancements in AI and software solutions are paving the way for renewed growth and optimism.

In its Q1 earnings call, Meta offered little insight into its ambitious metaverse plans, focusing instead on immediate revenue and user growth. The silence surrounding its virtual universe raises questions about the project’s direction and future priorities.

Meta and Microsoft soared following impressive earnings reports, showcasing resilience in a challenging market. This surge enabled Microsoft to reclaim its title as the world’s largest company, highlighting the tech industry’s ongoing strength and adaptability.